From Massachusetts to California, the biggest metropolitan hotspots for pharma manufacturing are running out of lab and manufacturing space. What does that mean for pharma companies today, when both the public and the stock market are expecting more — and faster — scientific discoveries?

It’s a difficult time for both established and emerging pharma companies. In some cases, budgetary belt-tightening has caused these companies to put off building their own facilities. Outsourcing manufacture to CMOs and CDMOs means contending with a backlog that, by some reports, can stretch 18 months or more.

And yet the opportunities for companies, especially in the cell and gene therapy market, have never been better. Former FDA Commissioner Scott Gottlieb estimated that by 2025, the agency will approve 20 or more cell and gene therapies each year. With so much anticipated development activity, it will become a priority for pharma companies to continue finding ways to manufacture for trials and at scale.

Forward-thinking service providers are now offering the pharma industry alternatives to beat the space crunch. Cleanroom licensing and cloud laboratories, for example, are emerging as new pathways for pharma manufacturing — because doing nothing is not an option.

Expanding outside the hubs

Not surprisingly, the rush for lab space maps directly onto the traditional areas for pharma manufacturing. Last year, a local San Diego newspaper detailed the problem in what is one of the nation’s top hubs for life sciences real estate.

“San Diego biotech companies such as Neurocrine Biosciences, Bristol Myers Squibb, Halozyme Therapeutics and PetDx do not have enough lab space,” according to the reporting. The city “has less than 200,000 square feet of vacant lab space available, which makes up less than 1% of the total supply.”

Meanwhile, on the East Coast, the commercial real estate brokerage and advisory services firm Kelleher and Sadowsky chronicled the lack of lab and current good manufacturing practice (CGMP) space in Boston and Cambridge.

“Occupancies in life science properties in Cambridge and Boston are essentially full, with vacancies below 3% for more than four years,” the firm said. As expected, rents are consequently going up. “Starting rents above $100/SF are now the norm in Boston, and several Cambridge deals have exceeded $100/SF,” they wrote.

Pharma companies in Massachusetts are now following Horace Greeley’s 150-year-old advice to “go west.” They’re looking at locations including Framingham and Devens — areas that might previously have been considered bedroom communities — to stake their claim while still staying close enough to the hub to remain part of the community.

In general, the outlying areas of San Diego and Boston are now seeing a variety of new alternatives to address the shortage of space. Among these is cleanroom licensing, coupled with other specialized CGMP and lab services, to enable the pharma market to scale with less risk. Companies are also offering virtual laboratory environments in the cloud to make the space crunch less of an issue altogether.

Solving near-term space issues

Every business balances its growth plans against what it has in the bank, and pharma companies are no different. To keep making the rapid discoveries seen over the past couple of years, pharma companies need access to lab facilities for research and development — that’s a given.

But it’s hard to justify the expense of creating a new lab facility that may not be fully occupied for years. The implications of that financial decision have prompted many companies to turn to CDMOs as a near-term alternative.

Consequently, CDMOs now have a lot more business than they can handle. These days, as previously described, a pharma company can expect to wait in line for 18 months or more for its turn with a CDMO. While the CDMO industry is investing in new construction (and teaming with cleanroom leasing companies), it will take awhile to catch up with its backlog.

Neither building its own facilities nor outsourcing can address the pharma industry’s overall near-term space needs, as companies strive to deliver innovations with the speed the public has come to expect and even demand. Of the alternatives, including things like modular cleanroom rental, the industry is turning more and more to cleanroom licensing, where companies can lease ready-to-use cleanrooms optimized for small-to-medium scale processes, R&D and early-phase manufacturing.

Cleanroom leasing as a bridging strategy

Cleanroom licensing enables pharma companies to get up and running with their development and manufacturing in a fraction of the time they’d need to wait for CDMOs, or for their own facilities to be designed and built. From strictly a business perspective, cleanroom licensing is a good risk management strategy for pharma companies budgeting for product development or looking for a bridge facility. It also offers an equally fast and fairly flexible way to scale up (or back) as business conditions require.

While Big Pharma can almost immediately address its development and manufacturing concerns with cleanroom licensing, smaller companies benefit too. Providers are offering a range of ‘wraparound services’ to empower startups with the tools they need to be compliant with federal regulations and operate using CGMPs. Some fast-growing pharma companies need help in very specialized areas, from safety practices in the facility to how materials should be stored and handled. With its CGMP envelope, cleanroom licensing gives these companies the leg up that they need to be ready for their next level of growth.

Contrary to what one might think, however, cleanroom licensing providers and CDMOs are not sworn adversaries. “CDMOs are not direct competitors of ours,” says Ravi Samavedam, chief innovation officer for Azzur Group, a company that offers ready-to-use cleanrooms in biotech hubs throughout the U.S. According to Samavedam, the company’s client list includes CDMOs.

In general, however, the appeal of cleanroom licensing has been particularly strong among pharma manufacturers. As announced in August 2021, Moderna became the anchor client for Azzur Group’s Burlington, Massachusetts location, using the space as a bridge facility for its groundbreaking mRNA manufacturing.

According to Samavedam, Moderna’s decision makes sense because the licensed space offers “a middle ground between building facilities and outsourcing development.” Cleanroom licensing can also be used for financial risk management. “With cleanroom licensing, pharma companies can manage their growth until they reach a point where they can build their own facilities,” Samavedam explains.

Both better-known brand names like Moderna as well as early-stage companies with comparatively little experience in manufacturing batches at scale for human trials can benefit from cleanroom licensing. For smaller companies, wraparound services may be nearly as valuable as the cleanrooms themselves. By addressing areas like materials management and storage, as well as qualification and training (among other things), these emerging entrepreneurial companies can be spared the headache of the nuts and bolts of running and staffing a full-scale pharma manufacturing company.

“We handle compliance so they can focus on the science,” Samavedam says.

A lab in the cloud

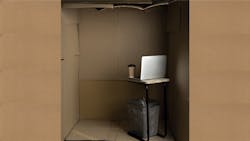

Other solutions for the pharma space crunch bypass the problem altogether by taking advantage of the cloud. Comprehensive new offerings allow companies to run experiments without ever setting foot in a lab at all.

Suppliers are offering remote access to a state-of-the-art lab environment, enabling them to run multiple experiments in parallel, 24 hours a day, 365 days a year, regardless of where on earth they may be physically located. Researchers are freed from the drudgery of managing their laboratory and can focus more on the work that moves research forward — designing new experiments and analyzing data.

Many companies are angling for a piece of this cloud lab market, providing fractional laboratory services or enhanced tools like Electronic Lab Notebooks (ELNs) and Laboratory Information Management Systems (LIMS).

This summer, Carnegie Mellon University’s Mellon College of Science plans to soft launch a $40 million cloud lab modeled after a cloud offering designed by Emerald Cloud Lab (ECL). That news makes Carnegie Mellon a true pioneer in life sciences research and education.

ECL recently announced a move from its original location in the San Francisco Bay Area to an even larger facility in Austin, Texas. Anticipated to open in July 2023, the 105,000-square-foot facility will house over 230 unique types of instruments needed to run most experiments. The instrumentation is all controlled by a single unified software interface that gives researchers access to over 4,500 different functions, including machine learning, image processing and multi-dimensional analysis.

“With cloud labs, access to the best laboratory equipment is democratized, leveling the playing field across the industry,” says Brian Frezza, co-founder of Emerald Cloud Lab. “Pharma companies no longer have to wrestle with the problem of whether to outsource research or spend money on building out facilities they aren’t ready to completely occupy.”

Doing nothing is not risk management

Regardless of which path pharma manufacturers take to address the laboratory and manufacturing space shortage, one thing is clear: They must choose.

Data from financial database provider Sentieo revealed that, of the biotech companies that went public in 2020, approximately 25% were trading below their cash balances. What’s more, venture capitalists and other industry observers are not looking favorably at current and future valuations for emerging pharma manufacturers.

For companies in that unenviable position, protecting their cash may seem like a good risk management strategy, but it will not dig them out of the hole. Pharma companies are valued by how quickly they can bring new treatments and therapies to market. That means time in the lab, regardless of industry demand limiting space availability.

Real risk management means making a choice about the pharma space crunch — one that will limit the risk to manufacturers’ cash position while also having a clear idea of how they will scale their operations in the future.