In a recent interview, Novartis CEO, Vas Narasimhan, told Wired magazine that when the pandemic hit, the pharma giant’s digital investment areas that had “previously seemed like nice-to-have experimental areas that may transform us in five years” suddenly became “things that were fundamental.”

It would seem that Novartis is not alone in this realization. Results from last year’s Pharma Manufacturing Smart Pharma Survey generated concern that the industry’s enthusiasm for the digital “revolution” was waning. But as we are all painfully aware, much has changed in pharma and the world since 2019. The pandemic put pharma’s digital progress to the test and this year’s optimistic survey results indicate that perhaps some of the industry’s commonly mentioned roadblocks were based on antiquated concerns.

And it’s possible that the pandemic will continue to drive digital change in the industry. Almost all pharma manufacturers surveyed agreed that the pandemic will alter the industry’s perspective towards digitalization, with 65 percent specifically believing that the pandemic will increase the industry’s use of technology to collect and analyze data in real time.

In this survey, “vendors” are defined as companies who offer pharma processing equipment, lab equipment, controls or software, as well as consulting or related services. “Pharma manufacturers” are defined as those who manufacture pharma/biopharma drugs, make APIs or excipients or offer contract manufacturing services. There were 263 total responses: 91 vendor responses, 140 manufacturer responses and 32 respondents who identified as “other” (“other” responses were included with manufacturer responses).

The sophistication of digital tools available to pharma manufacturers continues to grow. Digital transformation is the process of using these tools — smart sensors, artificial intelligence (AI), virtual reality and cloud-computing — to create new and better processes. Yet, digital transformation isn’t just about the technology — it’s a shift in mindset about how a company applies technology.

As pharma is finding out, today’s technologies have the ability to create the efficiency and flexibility needed to navigate uncertainty. Combining this technology with the right mindset will enable the industry to move forward with renewed confidence in its ability to thrive in a digital world.

Tossing broken records

The pharma industry’s aversion to risk, especially as it relates to implementing new technology, has endlessly played like a broken record in industry discussions. Yet when it comes to basic automation — the process of making tasks more efficient by using digital technology — recent evidence runs contrary to this widely held belief.

“It’s not uncommon to see a pharma company with a good amount of automation in place, to the point where they are claiming they have more data than they know what to do with,” says Rajiv Anand, CEO of Quartic.ai, which helps asset-intensive companies harness the data generated from their equipment and processes to create intelligence.

This exposure is reflected in the industry’s growing level of comfort with automation on the plant floor and in labs. Pharma Manufacturing’s Smart Pharma Survey, which separately polls drug manufacturers and equipment and services vendors about the pharma industry’s digital maturity, has seen rising confidence levels. This year, 93 percent of manufacturers and 87 percent of vendors believed that pharma has become more comfortable with automation.

Pharma is not averse to breaking the status quo either. When manufacturers were asked if, given the option, their company would choose to automate a manual plant process that is seemingly effective, 85 percent (the highest in survey history) said “yes.” Vendor optimism for pharma’s conscious choice to automate, while still lagging behind that of manufacturers, also increased this year (from 63 percent to 75 percent).

Endress+Hauser, a global supplier of solutions and services for industrial process measurement and automation, is among the optimistic, and notes a more significant embrace of Pharma 4.0 technologies by the pharma industry.

“These survey results indicate this conservatism may be changing to a more aggressive approach, perhaps because pharma firms are realizing the risks of relying on manual processes outweigh the costs of upgrading from manual to automatic,” says Bethany Silva, life science industry manager for Endress+Hauser USA.

Singing a new tune

There is an important distinction between automation and digitalization. While automation makes tasks more efficient through the use of technologies, digitalization goes a step beyond by collecting data and using it for advanced insight, thereby unlocking the benefits of true transformation.

This transformation requires a shift in mindset. To succeed, digitalization has to be prioritized, and pharma manufacturers appear to be doing just that. Over 93 percent of manufacturers surveyed said that when they are designing or upgrading facilities, digitalization is an important part of the discussion — and about a third of those respondents said digitalization is the lead priority. (Exhibit 1)

Vendors corroborated those numbers when asked the same question about their pharma customers — citing almost an identical breakdown.

Prioritizing digitalization and the collection of data is important, but it doesn’t automatically yield new insight. Here, the quality of the data being collected is pivotal.

According to Anand, pharma companies have historically collected data just-in-case. “And if they aren’t using the data, it means they aren’t actively monitoring the data’s quality,” he says. “Invariably that data has holes in it.”“Data is seen as the new currency in manufacturing,” says Brian Vogel, global sales executive at Rockwell Automation, the world’s largest company dedicated to industrial automation. “There is good currency and there is bad currency.”

Modern tools don’t offer much help if you are dealing with mountains of poor or incomplete data — a familiar scenario that can quickly dampen enthusiasm for digital initiatives.“If quality data isn’t there, there’s no magic you can do with advanced analytics,” says Anand.

Rather than stockpiling historic data, pharma manufacturers now have the tools to collect data in real time and then run performance analytics that yield immediate results.

According to survey results, pharma manufactures are recognizing the opportunity presented by these new tools. When asked to rank their top worries surrounding smart equipment in plants, pharma manufacturers ranked concerns about innovative technology (specifically the claim that technology being offered to the pharma industry isn’t advanced enough) near the bottom of the list. (Exhibit 2)

Digital tune ups

Looking at the big picture, more than 75 percent of pharma manufacturers surveyed believe that a more automated pharma industry will lead to improved productivity, quality and efficiency. This year, the number of respondents who also see the correlation between a more automated plant and reduced costs and increased innovation, has risen.

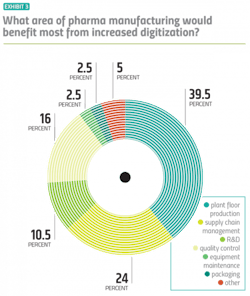

More specifically, both drug manufacturers and vendors agree that plant floor production would see the most benefit from increased digitalization — a belief that has stayed consistent throughout the history of this survey. This year, about a quarter of pharma manufacturers — more than ever before — point to supply chain management as the space that could potentially benefit most from a digital tune up. (Exhibit 3)Anand points to another high-impact, measurable area that wasn’t included as an option on the survey: Scale-up.

Tech transfer, which, at its most basic, involves transferring processes from R&D to the production floor, has long been marred by data silos and a lack of cohesive data management. At times, the digital systems used by researchers do not integrate with the systems used on the production floor. As a result, many companies turn to manual processes, such as spreadsheets and PDFs.

“Generally, pharma has good data in the process development stage, but the scale-up process involves a lot of manual data analysis,” says Anand. “Having good initial data means modeling will be based off a solid foundation of data.”

A foundation built from quality data creates the opportunity for digital transformation.

With many global pharmaceutical giants boasting robust drug pipelines, a more efficient tech transfer process will enable them to get products onto the market.

“In this space, digitalization directly hits the bottom line in terms of speed to market,” says Anand.

Pushing the needle

There is a lot of talk about digital transformation, but what about actual progress? When asked to evaluate their own company’s progress on digital transformation/IIoT initiatives, a quarter of pharma manufacturers claim to be in the most advanced stage: They have identified applications and have made investments to match. But on the flipside, almost half admit their companies are still at the starting gate. (Exhibit 4)

Insight from vendors, many of which are selling digital technologies to pharma companies, is also relevant to the discussion. When asked to evaluate the pharma industry’s collective progress, 41 percent of vendors think the industry is still at the starting gate and around 46 percent put pharma in the middle stage: identifying early applications to pilot. Only 13 percent believe the pharma industry has reached the investment stage.

The variability in survey answers can partially be attributed to the lack of a standard, unified method for evaluating a company’s digital transformation progress. For vendors who sell digital solutions, sorting through this variability is crucial for success.

“As a vendor, you can’t judge. You have to understand where organizations are at,” says Vogel.

This assessment has to be thorough and consider more than just the end goal of digital transformation, explains Vogel. “It’s great to focus on the outcome you want, but you need to look at this with a wider lens.”

This wider lens is necessary because change in pharma doesn’t happen in a vacuum.

Vogel uses the example of a Rockwell customer that wanted to focus solely on production management — with the specific goal of raising production output. Rockwell asked what changes they would be making to packaging and shipping, pointing out that an increase in production yield will have a ripple effect on other areas of the business.

“You have to look at the whole totality of your process to understand what the underlying problems might be and what is the appropriate starting point to fix them,” says Vogel.

Silencing progress

Despite pharma’s more open-minded attitude towards smart equipment on the plant floor, logistical concerns still linger. (Exhibit 2) For the past three years, the top concern associated with smart equipment, noted by both pharma manufacturers and vendors, has been difficulty integrating new technology with existing lines or equipment.

The No. 2 concern, also agreed upon by both manufacturers and vendors, is regulatory hurdles, specifically the lack of regulatory buy-in or understanding of new processes.

While these concerns are not without merit, especially in a highly regulated industry that operates a considerable amount of legacy facilities with aging infrastructures, Anand says it’s important to dig deeper with pharma customers, making the distinction between perceived barriers and actual barriers to adoption.

“Have you actually tried or are you just making an assumption based on the status quo?” asks Anand.

On the regulatory end, the U.S. Food and Drug Administration has made strides towards shaking the agency’s dated reputation as innovation blockers. In 2014, the FDA’s Center for Drug Evaluation and Research’s (CDER) Office of Pharmaceutical Quality created the Emerging Technology Program which enables pharma companies to meet with the agency to discuss, identify and resolve potential technical and regulatory issues regarding the development and implementation of a novel technology, prior to filing a regulatory submission.

According to Rockwell, technology improvements have also helped break down a lot of pharma’s traditional barriers to digital adoption.

The foundational aspects of digital transformation that used to involve putting expensive, complex infrastructures in place have evolved, explains Vogel. “Rather than putting excessive infrastructure in place, now we have a toolset that can be applied unilaterally — very quickly without a lot of heavy lifting — to whatever data stream deemed necessary,” he says.

Quartic.ai notes an additional barrier to digital transformation that was not mentioned in the survey. The frequent movement of workers in the pharma industry — both internally to different positions and externally to different companies — means technology vendors like Quartic.ai are constantly working with new customer teams.

“Any new technology requires dedication,” says Anand. “In pharma, employees move around so much that we are constantly losing our digital champions.”

Rockwell sees this employee turnover as a potential opportunity for vendors to step up and keep pharma on task, by propping up customers in the interim and assuming more ownership of the project.

“When people leave, vendors need to remind pharma of the importance of staying committed to the digital program,” says Vogel.

Who are the champions?

The concept of “digital champions” warrants additional discussion. Does the push to transform pharma manufacturing always come from within? Surely equipment manufacturers and software providers — those providing pharma with the tools to progress — play a crucial role in championing the digital cause?

Just how crucial is up for debate. In survey results, neither pharma manufacturers nor vendors themselves could come to a consensus in terms of the extent to which vendors should push the industry. Should vendors be proactive, leading the charge by offering innovative products and education? Or should they take a more reactive role, by adapting products to the needs of manufacturers? For the slight majority of those surveyed, the answer lies in the middle. About 41 percent of pharma manufacturers and 38 percent of vendors think collaboration is key.

For Rockwell, strong, long-standing relationships with pharma customers, such as Pfizer, have been instrumental to advancing digital transformation within the industry.

When the pandemic hit, Pfizer was able to roll out remote collaboration tools in two weeks, which allowed employees to train with global subject matter experts through augmented reality via smart glasses and mobile phones. The drugmaker now is able to access shop floor data remotely, as they expanded their investment in security to ensure data protection during remote access —- which became critical for continuing operations amid the pandemic.

Pfizer’s digital preparedness was the result of a nearly two-decade working relationship with Rockwell that has evolved along with technology.

“Rockwell has been working with Pfizer before today’s advanced toolsets were even available,” says Vogel, who manages Rockwell’s relationship with Pfizer. “Now we can connect systems in a single ubiquitous way that previously was not possible.”

Today’s technology vendors need to be more than just “data concentrators” if they want to win the trust of pharma customers.

“We [Rockwell and Pfizer] are partners. We got honest. We looked at what we were going to be good at, bad at, looked at what our challenges would be…we spent time figuring out how to meet those inflection points in a way that we could both mitigate and control,” says Vogel.

As more third parties, such as systems integrators or industry consultants, become involved in pharma’s digital transformation process, vendors are increasingly taking on the digital champion responsibilities. Vogel says in his experience, it is not uncommon for pharma manufacturers to hire consultants to evaluate manufacturing processes and inefficiencies. Armed with this important insight, the drugmakers then approach companies like Rockwell for help understanding and implementing the findings.

“Pharma wants to do this but often don’t know how to start,” says Vogel.

New processes, such as continuous manufacturing, are further driving pharma’s need for outside support.

“We see pharma customers wanting support for automation related to managing the reality of the speed and magnitude of data associated with continuous manufacturing relative to batch,” says Lisa Graham, vice president, Analytics Engineering, Seeq Corporation.

The backbone of new processes like continuous manufacturing is the real-time monitoring of massive amounts of data.

“For context, continuous manufacturing enables the collection of large data sets (~55,00 data points per campaign) and decisions must be made quickly,” says Graham.

COVID and beyond

The lasting effects of the COVID-19 pandemic are still a story being written, but it’s clear that the pandemic will put an asterisk next to all data and survey information collected in 2020. Of course, digital transformation in pharma is not a switch that was flipped as soon as the pandemic forced the world to turn to digital solutions. The infrastructure, both in mindset and technology, has been a work in progress for years within the pharma industry.

But one can’t help but wonder if the more positive digital outlook observed in this year’s survey can be chalked up to pharma being put to the digital test — and performing better than anticipated.

In the same Wired interview mentioned previously, Novartis’ Narasimhan commented, “We were better prepared than I expected. If you had asked me in January if we had taken 110,000 people and most of them turned virtual and our operations would still run, I wouldn’t have believed it.”

Pharma’s altered perspective towards digitalization has widespread potential impact within the industry. According to survey results, 60 percent of pharma manufacturers and 46 percent of vendors believe the pandemic will trigger an increased interest in digitizing the pharma supply chain.

“COVID has highlighted the supply chain dependency risk across all industries, but more significantly in the pharma industry. This likely will provide a greater push in the direction of digitalizing the supply chain, again requiring more automation of previously manual processes,” says Silva.

The role improved technology has played in increasing digital optimism should not be downplayed.

“It’s simply not as hard as it used to be because technology has leap frogged a lot of traditional challenges,” says Vogel.

But you don’t have to take vendors’ word for it — in this year’s survey, pharma manufacturers ranked the concern that “technology being offered to the pharma industry is not advanced enough” at the bottom of the list of worries.

With almost half of pharma manufacturers and 55 percent of vendors surveyed believing the industry will have truly reaped the benefits of IIoT and smart factories within the next five years or less, pharma is edging closer to its digital transformation.

“These last couple of months have really enlightened both the vendors and the manufacturers that they need to be a lot more nimble and focused on solving immediate problems, while also keeping an eye on the prize of making sure they have tools that can grow with them,” says Vogel.

About the Author

Karen P. Langhauser

Chief Content Director, Pharma Manufacturing

Karen currently serves as Pharma Manufacturing's chief content director.

Now having dedicated her entire career to b2b journalism, Karen got her start writing for Food Manufacturing magazine. She made the decision to trade food for drugs in 2013, when she joined Putman Media as the digital content manager for Pharma Manufacturing, later taking the helm on the brand in 2016.

As an award-winning journalist with 20+ years experience writing in the manufacturing space, Karen passionately believes that b2b content does not have to suck. As the content director, her ongoing mission has been to keep Pharma Manufacturing's editorial look, tone and content fresh and accessible.

Karen graduated with honors from Bucknell University, where she majored in English and played Division 1 softball for the Bison. Happily living in NJ's famed Asbury Park, Karen is a retired Garden State Rollergirl, known to the roller derby community as the 'Predator-in-Chief.'