Recharging pharma's digital revolution

Revolutions start with a compelling story. These stories allow us to imagine the ways in which our lives — or industries — will transform.

Much has been written about the alluring promises of the Fourth Industrial Revolution. Tools such as smart sensors, artificial intelligence (AI), virtual reality, and cloud-computing offer potential that at times seems like something out of a science fiction movie. Pharma, while known for being slow to adopt change, has real problems that need solving — rising cost pressures, the manufacturing complexities of new classes of therapies, unrelenting regulatory demands — and digitalization has put forth many possible solutions.

But digital transformation in pharma is more complex than the simple flipping of a switch. Digital technology will absolutely play a widening role in pharma’s future, but not without the industry overcoming significant hurdles. All eyes are now on how digitalization will progress in the risk-averse pharma industry. To that end, Pharma Manufacturing’s third annual Smart Pharma survey separately asked 235 drug manufacturers and equipment and services vendors* their thoughts on the pharma industry’s digital maturity.

Revolutions involve risk and the industry’s willingness to assume this risk will invariably affect its pace of advancement. Close analysis of this year’s survey results, especially when compared to previous survey results, generates concern that the realities of digital transformation have set in and pharma’s enthusiasm for the digital revolution is waning. What is holding pharma back and what does this mean for the future of digitalization in the industry?

*For the purposes of this survey, “vendors” are defined as companies who offer pharma processing equipment, lab equipment, controls or software, as well as consulting or related services. There were 77 complete vendor responses. “Pharma manufacturers” are defined as those who manufacture pharma or biopharma drugs, make APIs or excipients or offer contract manufacturing services. There were 121 complete manufacturer responses.

Aspirations vs actions

The distinction between automation and digitalization is subtle, but important. While automation makes tasks more efficient by using digital technologies, digitalization goes a step beyond by collecting information and using it for advanced insight, thereby enabling true value-add transformation. “Automation usually assumes a firm is trying to keep pace with the times, but digitalization can mean setting the pace,” explains digital onboarding experts, Agreement Services.

On the positive side, the vast majority of those surveyed (88 percent of pharma manufacturers and 85 percent of vendors) believe that the pharma workforce is becoming more comfortable with automation in general — and these numbers have risen from previous survey years.

Looking at the big picture, over 70 percent of manufacturers believe that in the long-run, a more automated pharma industry will improve productivity, quality and efficiency. Yet, the correlation between automation and benefits such as cost-cutting and innovation is not yet fully being realized, with only 59 percent and 36 percent (respectively) acknowledging these as advantages that come with increased automation.

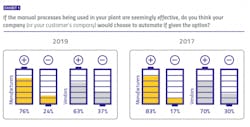

The lack of a tangible connection between digital improvements and these two important drivers in the pharma industry could potentially explain what appears to be declining optimism when it comes to the decision to take action. When pharma manufacturers were asked if they thought their companies would choose to automate manual plant processes that were seemingly effective as-is, 24 percent said no. When vendors were asked the same question regarding their customer’s plants, 37 percent said no. These “no” votes have increased each year of the survey, suggesting a hesitation to move beyond status quo.Neutral ground

In today’s digital age, drugmakers who are building new manufacturing facilities or updating existing ones are likely to discuss the new computing, control and communications technologies represented by the IIoT — but to what extent? When drugmakers were asked how important digitalization was to the discussion during designs or upgrades, about half landed in the neutral category, saying “important but not our biggest priority.” Just 32 percent said digitalization was a leading priority.

Vendors — many of whom are selling these advanced technologies — were asked the same question in reference to their customers. While 68 percent of vendors also chose the neutral “important but not a priority,” less than 19 percent felt that digitalization was dominating the discussion.

When it comes to moving beyond the discussion and taking action, vendors continue to report lukewarm results from drugmakers — half of surveyed vendors said some pharma companies are looking to replace outdated equipment with improved robotics and controls, while others are not. Only 9 percent of vendors were able to confidently report that “most pharma companies are looking to replace outdated equipment.”

These results probably do not come as a surprise to anyone in the industry. The administrative and regulatory procedures required before new equipment can be installed and operated can result in advanced digital technologies being viewed as simply too risky, too complicated and too costly. Despite this, experts promise the payoff is worth it. McKinsey, for example, says that even in the initial phases of digital transformation, plants can see reductions in deviations of up to 80 percent and reductions in changeover times by more than 30 percent. Once companies push through into the pilot stage, they can expect an additional 50 percent increase in terms of efficiency, quality, and flexibility metrics.

Where pharma stands

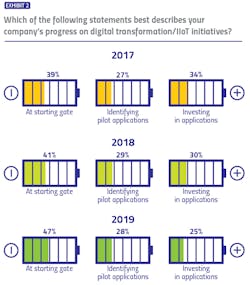

While the industry lacks a formal, unified methodology for evaluating digital transformation progress, our survey identified three buckets in which respondents could potentially place themselves: At the starting gate, with focus on learning and exploration; identifying early applications to pilot; and already identified applications and made investments to match.

For three years, we have asked pharma manufacturers to describe their own company’s digital transformation progress — and results are trending in the wrong direction. The percentage of respondents reporting their companies are at the starting gate has increased each year of the survey (from 39 percent to 47 percent), while the percentage reporting their companies have made investments has decreased (from 34 percent to 25 percent).When asked to describe the pharma industry’s collective progress on digital transformation initiatives, responses took on a more neutral tone, with 44 percent of pharma manufacturers and 41 percent of vendors believing the industry is in the middle (pilot) stage. Only 17 percent of manufacturers and 14 percent of vendors believe that the industry is in the most advanced stage of digital transformation.

To put these results in perspective, we can look at digital transformation across a broader industrial landscape. In a recent Digital Transformation: 2019 State of Initiative report, Smart Industry surveyed over 600 professionals from across manufacturing, processing and related industries.3 When asked about their company’s progress on digital transformation initiatives (using the same three buckets used in our survey), the majority reported that they were in the pilot stage. Just 18 percent reported to still be at the starting gates and 31 percent said they are already investing in applications.

Without successful pilots to motivate pharma to launch digital initiatives at scale, it will become increasingly difficult for the industry to capture the substantial value that other industries are experiencing.

Biggest battles

What is holding pharma back from progressing in its digital transformation journey? When asked to rank their companies’ concerns (or for vendors, their customers’ concerns) regarding smart equipment in plants, for the second year in a row, both manufacturers and vendors prioritized integration — specifically the potential difficulty that comes with integrating new technology with existing lines or equipment.

These results are not surprising in an industry that operates legacy facilities that grapple with aging infrastructure, equipment and processes. Many legacy systems are incompatible with new technologies, and the concern is that legacy modernization can lead to production downtime and high costs.

Each survey year, “regulatory hurdles” descends in the ranking of concerns noted by pharma manufacturers. While the industry’s hyper-focus on compliance has traditionally hindered the speed at which pharma can adopt new solutions to improve product quality and safety, the U.S. Food and Drug Administration has stepped up its support of automation systems and digital technologies throughout the pharma product lifecycle. To this end, the agency announced the launch of a DSCSA pilot project program intended to test modern approaches for enhanced tracing and verification of drugs and has promised to release the much-anticipated new draft guidance, “Computer Software Assurance for Manufacturing, Operations, and Quality System Software,” before the end of this year.

It’s also important to note what isn’t a major concern, according to survey respondents. For manufacturers, the lowest ranking concern this year was “ROI,” specifically the concern that the return on digital tools was not enough to justify the investment. With each passing year, the technology needed to enable digital transformation becomes more affordable and accessible, and survey results reflect this shift.

The lowest ranking concern according to vendors has remained consistent: “innovation — technology being offered to the industry is not advanced enough.” Vendors remain confident about their technology offerings and those of the industry, despite the fact that pharma might not be ready to adopt these technologies at scale.

Taking charge

Manufacturer’s concern with education in relation to smart equipment begs the question of who bears the responsibility of enabling technology to work with existing operations and training employees to use this technology properly — a major factor that must be considered when driving the industry to automate.

When asked what role equipment manufacturers and software providers should play in pushing the drug industry to automate, results indicate a possible disconnect within the industry. A rising percentage (up from 37 to 45 percent) of drug manufactures feel equipment vendors should proactively lead the charge by offering innovative products and education. Last year, more than half of vendors agreed with this assessment; this year the number plummeted to 37 percent.

Both vendors and manufactures expressed a growing interest in collaborating on new automation offerings, with 49 and 40 percent (respectively) believing that this middle ground is key to progressing the digital revolution.

Transformation timeline

Despite having a clearer picture of the complexities of digital transformation laid out before them, pharma’s timeline of expectations hasn’t changed much.

With around three quarters of all those surveyed estimating that the pharma industry is somewhere between five-10 years away from truly reaping all the benefits of IIoT and the “smart factory,” pharma’s ability to gain momentum will determine its future. This five- to 10-year timeframe hasn’t changed since our first survey and the clock is ticking. Digital is transforming the world in which we live, and despite significant logistical, regulatory and cultural barriers, pharma is no exception.

Survey respondents have consistently indicated that they view larger-sized biotechs as the most highly automated and digitally-advanced pharma manufacturers in the industry. Examining the digital strategies of these companies may help create a clearer path towards digital transformation.

A successful revolution can have many positive outcomes — for pharma, it can mean very measurable gains in quality, speed and efficiency. But keeping in mind the ultimate goal — better treatments for patients —will help motivate true digital transformation.

About the Author

Karen P. Langhauser

Chief Content Director, Pharma Manufacturing

Karen currently serves as Pharma Manufacturing's chief content director.

Now having dedicated her entire career to b2b journalism, Karen got her start writing for Food Manufacturing magazine. She made the decision to trade food for drugs in 2013, when she joined Putman Media as the digital content manager for Pharma Manufacturing, later taking the helm on the brand in 2016.

As an award-winning journalist with 20+ years experience writing in the manufacturing space, Karen passionately believes that b2b content does not have to suck. As the content director, her ongoing mission has been to keep Pharma Manufacturing's editorial look, tone and content fresh and accessible.

Karen graduated with honors from Bucknell University, where she majored in English and played Division 1 softball for the Bison. Happily living in NJ's famed Asbury Park, Karen is a retired Garden State Rollergirl, known to the roller derby community as the 'Predator-in-Chief.'