When it comes to the adoption of disposables in biopharmaceutical manufacturing the rate continues to grow, as it has for the past several years. This is especially true in relation to pre-commercial scale production, including clinical and preclinical applications.

The industry is hungry for innovation in this area, and end-users continue to seek better ways to speed campaign changeovers, reduce shut-down times in the production of monoclonals and lower overall production costs. Single-use systems are now being used for a wide range of applications including upstream expression, filtration, purification, storage, mixing, processing and separating biotherapeutics. Some single-use equipment use is almost ubiquitous at the early stages of manufacturing, which begs the question: Which areas are seeing the greatest upswing in recent implementation?

Our newly released 10th Annual Report and Survey of Biopharmaceutical Manufacturers, offers some insight into areas that have seen recent growth in disposables implementation. As part of our study — which takes an in-depth look into trends in this area — we asked 238 biomanufacturers to indicate which disposable systems had been introduced at their facilities over the past 12 months.

Top Five

For the third consecutive year, we found that “bioreactors, production” were the leading “newly introduced” system, cited by 46.6% of respondents this year. That follows a large jump last year, as well as in 2010. The data suggests that the rate of implementation of disposable production bioreactors has steadied, perhaps likely due to these companies nearing a level of maturity in adoption, at least at pre-commercial scale.

Next on the list we find buffer storage, noted by 40.9% of respondents, up from roughly 35% last year. Bioreactors, seed (37.5% having newly introduced), buffer prep (30.7%), and mixing (28.4%) round out the top 5 newly introduced systems, although recent implementation rates of each of those has slowed from previous years. Beyond those top 5 (see Figure 1), some noteworthy changes in this year’s data include:

- Media storage, newly implemented by 27.3% of respondents, the highest level in at least 5 years;

- Tangential flow filtration, newly implemented by 19.3% of respondents, rebounding after 3 consecutive years of decline;

- Filtration (normal flow), newly implemented by 17% of respondents, down significantly from 30.5% last year and 37% in 2011; and

- Seed train, newly implemented by 13.6% of respondents, the lowest level in several years.

We note that respondents could be mistaken in their estimate of when introduction took place and they could be mixing up major purchases with new introductions, so there may well be overlap between previous years’ responses about when products were implemented. However, we see much consistency from 2007 to the present, so these data are useful for their relative values and trends.

Disposable Devices Penetration Of Commercial Stage

Given strong rates of recent implementation for some devices across a growing time span, it’s easy to understand how certain disposable devices have reached widespread use in the industry. This year, for example, we find that among users of disposables, at least 8 in 10 report using disposable filter cartridges (92%), tubing for disposable applications (88%), depth filters (85%), buffer containers (82%) and media bags, purchased dry (81%) at some stage of R&D or manufacture. In fact, these devices have become the primary option, with 100% of our CMO respondents reported adoption of common devices such as disposable filter cartridges. CMOs also indicate strong adoption of other systems such as waste containers (78.6% of CMOs versus 57% of biotherapeutic developers).

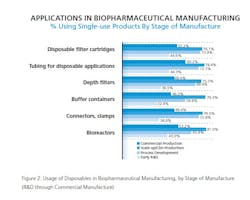

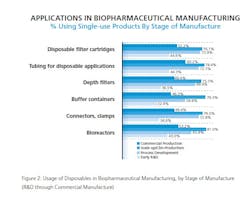

Of course, it’s widely accepted that within the industry single-use devices are mostly used in scale-up and clinical production rather than in commercial production. Yet even on this front, our data shows that some applications are making inroads.

Bioreactors certainly stand out in that regard. This year, 53.2% of respondents reported using bioreactors in commercial production, more than double last year’s 25.3%. That suggests that those respondents who newly introduced bioreactors into their facilities in the past year may have deployed them in the commercial stages of production.

Bioreactors aren’t the most commonly used device at the commercial stage of manufacturing. That distinction belongs, not unexpectedly, to tubing for disposable applications, used by 60.2% at commercial stage, up from 49.5% last year. Pre-assembled tubing sets, rigging kits, etc. (57.1%, up from 50%) aren’t far behind, with a majority also using disposable filter cartridges (52.2%, relatively flat from 53.8%) and tangential flow devices (52.2%, up from 36.9%) at the commercial stage. Not So Fast

Not all single-use applications are seeing increased adoption at the commercial stage, though (see Figure 2). Some appear to have leveled off this year, including:

- Connectors, clamps, for commercial production this year, around 50%;

- Mixing systems, down to 35% from 42% in 2012;

- Waste containers, down from 46% in 2012 to around a third of respondents this year;

- Single use sampling systems, appear to have declined at commercial stage, down to 25.6% this year.

A Fully Disposable Facility?

While not all single-use applications are making their way into commercial stage, data from our study suggests that disposable products will become more pervasive in the latter stages of manufacturing. But what about a 100% disposable facility? We posed the question to the industry, finding that more than 4 in 10 respondents either strongly agree (18.4%) or agree (27.6%) that they expect to see a 100% disposable facility in operation within five years. Confidence in such a scenario was significantly higher among U.S. (57.1%) than Western European (43.5%) respondents. In fact, American respondents were as likely to agree that they expect to see a 100% disposable facility in operation within five years as to agree that they expect to retrofit existing facilities with disposables, rather than designing entirely new facilities.

Vendor Concerns Hinder Further Uptake

In order for the single-use market to expand further, there are areas in which the industry believes vendors need to improve. For example, slightly more than half (53%) of our study’s global respondents agreed that vendors today do not provide sufficiently scalable single-use disposables and techniques, with this concern higher among U.S. respondents (58%).

To determine whether end-users are obtaining the quality, products and service they require in their disposables, and whether any potential dissatisfaction might have an impact on adoption rate of disposable technologies, we asked respondents to describe their satisfaction levels with their current vendors across a set of attributes. We then compared those satisfaction ratings against the levels of importance respondents assigned to each attribute. By assessing the importance of an attribute, and comparing that to the level of satisfaction (or dissatisfaction) with vendors to this industry segment, we can identify and quantify gaps between the quality of service and products offered, and the importance of each attribute. This can be used to prioritize specific areas that are both most important and most in need of improvement.

In 2013, we found the largest shortfall with vendors to be related to the cost of their products, with a significant 63.7 percentage point gap between the importance of the attribute (with 79.3% indicating it to be important or very important) and the satisfaction with it (with just 15.6% of respondents indicating the factor is being addressed in a satisfactory or very satisfactory way.)

We found other large shortfalls, too, with several gaps in the ~55 percentage point range. These included:

- “Provide useful quality data”

- “Performing leachables and extractables testing using current systems”

- “Willingness to accept and fix integrity (leakage) problems”

- “On-schedule delivery”

- “Providing leachables and extractables data that regulators will accept”

Many of the shortfalls measured this year have grown from last year. Unfortunately for vendors, those gaps appear to have widened more as a result of lowered satisfaction levels on the part of end-users this year than of higher levels of importance attributed to the selections. For example, last year 30.8% of respondents were “satisfied” or “very satisfied” with vendors when it came to the cost of disposable products, yet this year that figure halved, to 15.6% of respondents.

End-Users Expect Better

One single-use area that bucked the trend of lower satisfaction was standardization of devices. But that’s not to say that end-users are at all pleased with vendors’ progress in this area. This year, only about one-quarter (26%) of our study’s respondents said they are satisfied to some degree with the standardization of devices offered by vendors. That was one of the few attributes to see a slight rise in satisfaction, from last year’s 21%.

But end-users are attaching more importance to this issue now, meaning that the shortfall between satisfaction and importance has actually grown. Indeed, our data suggests that 3 in 4 respondents find standardization of devices to be “important” or “very important,” a significant rise from 63.5% who assigned this attribute that level of importance last year.

But end-users are attaching more importance to this issue now, meaning that the shortfall between satisfaction and importance has actually grown. Indeed, our data suggests that 3 in 4 respondents find standardization of devices to be “important” or “very important,” a significant rise from 63.5% who assigned this attribute that level of importance last year.

So where is standardization most important? This year, materials used in bags and tubing showed up as “very important” and standardization in this area will likely spur development of regulatory documentation. Meanwhile, connector standardization was “very important” to nearly half the industry. Connector compatibility permits inter-connectability between various components, and between different vendors’ devices. This plug-and-play approach may increase the adoption rate of single-use systems overall, but would require a degree of coordination on the part of global vendors — something easier said than done.

Let The Enthusiasm Continue

It’s clear from our data that enthusiasm regarding the development of single-use systems continues, even if the rate of growth of these devices may have slowed in some areas. There are still issues of standardization standing in the way of increased adoption, and end-users will likely become more demanding of their vendors over time. Nevertheless, as regulatory concerns are addressed — and concern over leachables and extractables subsides — we can expect to see further usage of disposables in the commercial stages of manufacturing. And perhaps those 4 in 10 respondents predicting a fully disposable facility within 5 years will be proven correct.

Published in the June 2013 edition of Pharmaceutical Manufacturing magazine

References:

10th Annual Report and Survey of Biopharmaceutical Manufac-

turing Capacity and Production, April 2013, Rockville, MD,

www.bioplanassociates.com/10th

About the Author

Eric Langer

BioPlan Associates

Sign up for our eNewsletters

Get the latest news and updates