Benchmarking Shows Need to Improve Uptime, Capacity Utilization

Manufacturing enterprises gain competitive advantages when they focus on operational excellence initiatives like Six Sigma, Lean Manufacturing, Total Productive Maintenance and other continuous improvement methods. They set goals to unlock capacity and reduce inventory and labor costs, while increasing productivity without additional capital investment. Leading manufacturers meet these goals by identifying and measuring key performance indicators (KPIs) within and across facilities on an ongoing basis.

From January to June of this year, Informance studied 50 pharmaceutical manufacturing lines worldwide. Researchers used The Informance Enterprise Manufacturing Intelligence Suite (including patented analytics), and IMPACT Advisory Services to collect data, derive insights and discover correlations to operational success of tactical and strategic actions.

They learned that:

- Best-in-class pharmaceutical manufacturers exhibit 87% more availability than laggard performers

- Best-in-class performers reduce loss due to changeover at a factor of four times greater than laggards

- Equipment failure is a significant contributor to lost capacity; however, best-in-class pharmaceutical manufacturers report equipment failure at 7% of capacity, versus laggards that experience a staggering 26% of capacity lost due to equipment failure.

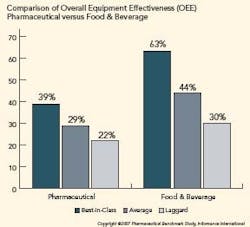

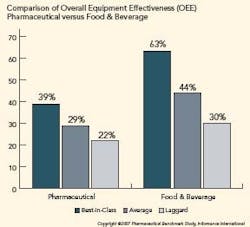

Pharma is Under Utilizing OEE

OEE in the pharmaceutical industry is significantly lower than other manufacturing verticals. The figure below illustrates the difference in OEE between pharmaceutical manufacturers and their counterparts in food and beverage manufacturing. Further analysis shows that availability is the primary reason pharmaceutical OEE lags.

To determine an organization’s competitive position, Informance ranks each key performance indicator from each organization from best score to worst score. The top 20th percentile represents best-in-class organizations, the middle 50th percentile represents average companies, and the bottom 30th percentile represents laggards.

Informance uses the term “Cycle Erosion” to describe performance loss from minor stops, hesitations, reduced speed and operator fatigue. Best-inclass pharmaceutical manufacturers experience 9.5% Cycle Erosion, while the remainder of the industry experiences Cycle Erosion of up to 12.5%. By comparison, best-inclass food and beverage companies experience only 3.2% Cycle Erosion.

The study categorized downtime in standard capacity loss buckets – known as the “Big Six” – which include preventative maintenance, breaks and lunches, training exercises, and other miscellaneous production stops.

Operational downtime includes adjustments or related equipment losses that are not direct failures during scheduled run time. Changeover downtime is capacity lost during changes in material, equipment or product. Equipment failures incorporate the time lost when equipment unexpectedly becomes dysfunctional or inoperable. Process failures include losses resulting from replacing defective raw materials; operating errors, leaks or spills; and supply and demand of key packaging materials. Production adjustment losses reflect time spent on changes in supply and demand that required changes to production plans and demand for main product material.

The characteristics that differentiate best-in-class enterprises from average and laggard performers are visibility of key metrics, more frequent measurement of those metrics and an understanding of the financial impacts of change — positive or negative.