The demand for cleanrooms used in biopharmaceutical facilities continues to grow significantly. Virtually every facility producing biologics or pharmaceuticals has at least one cleanroom. Technologies for cleanroom design and construction have changed in recent years due to increasing concerns over contaminating building materials, regulatory issues, operational efficiencies, and increased interest in faster modular and pre-fab podular construction.

Cleanrooms are the enclosed, classified spaces used for processing bio/pharmaceuticals in a contained space with controlled reduction of airborne particulates, including microbes, generally with a classification of ISO 5-9.

Cleanroom market segments can be categorized based on applications and design types. Applications include:

- Drugs – small molecules; chemical manufacturing

- Biopharmaceuticals – large molecules; biotechnology/living organisms manufacturing

- Cellular/gene therapies – a new and rapidly growing subset of biopharmaceuticals

Cleanroom design types include:

- Traditional “stick built” – constructed from individual parts onsite, such as brick-by-brick, frame-by-frame, wall by wall, etc.

- Modular construction – major room modules/parts (walls, floors, etc.) constructed off-site for onsite assembly

- Pre-fabricated units, including PODs – largely finished free-standing/autonomous rooms constructed and outfitted offsite, often including all electrical/automation/HVAC prequalified, sometimes with bioprocessing equipment installed, such as G-Con units. These are shipped either as finished single units or multi-blocks and installed at the facility.

Market overview

At present, the global cleanroom market (for all technologies, not just bio/pharma) is around $12 billion/year. The market is dominated by the electronics/semiconductor industry, with about 60 percent market share. The pharmaceutical industry accounts for less than 40 percent of the total market, or currently about $5 billion/year. The overall cleanroom industry revenue growth is somewhat lower than the ≥12 percent growth rate generally seen in the biopharmaceutical supplies markets. However, the segment continues to expand at between 8-10 percent annually. This slightly lower growth rate is due partially to the focus on greater efficiency in the industry which can result in smaller cleanrooms able to maximize productivity in existing spaces. Although, new cleanroom infrastructures for the cell and gene therapy sector are growing more rapidly, as these new therapeutic entities start maturing and require processing spaces.

The total number of installed/in-use bio/pharmaceutical cleanrooms (in the ISO 5-9 range) is estimated at more than 8,000 worldwide. There will be an estimated total of 11,000 pharmaceutical cleanrooms in 2025 and 15,000 in 2030, including large numbers added for cellular and viral vector gene therapies manufacturing.

BioPlan’s Top 1000 Biopharmaceutical Manufacturing Facilities Index includes approximately 1,050 bioprocessing and R&D facilities with ≥500 L total capacity (total onsite bioreactor volume), with each of these estimated to have on average just over three standard cleanrooms (a total of around 3,400 cleanrooms). In addition, another ~500 smaller bioprocessing facilities increase the total bio/pharma cleanrooms to around 4,500.

There are around 2,000 cleanroom installations or sales per year, including replacements/major upgrades and new facility cleanrooms. The cost for an average cleanroom can range from under $1 million, to a typical $2.5 million cost, or more. This would include the equipment and services, with larger ones likely used for commercial manufacturing costing much more. This comes out to around $1,000-1,250 average cost per sq. ft. for new GMP compliant cleanrooms in developed countries. The market revenue is at present made up mostly of traditional stick-built (components built from scratch, not pre-built) facilities, including the largest cleanrooms.

Market by application areas

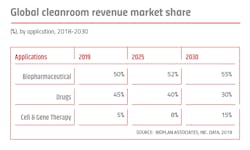

The cleanroom market can be segmented into three sectors: drugs, biopharmaceuticals and cellular, and gene therapies.

Nearly 50 percent of pharmaceuticals in development are now biopharmaceuticals, and with biopharmaceutical manufacture generally involving greater complexity in the process and more stringent containment requirements vs. synthetic drugs manufacturing, about 55 percent of the cleanroom market revenue currently involves biopharmaceutical facilities.

Currently, the cell and gene therapy market accounts for the lowest share of the market due to the novelty of this area, including relatively few current facilities and most facilities still being small and only supporting R&D and pre-clinical/clinical manufacturing. This sector is seeing the most rapid growth, with increases in the number and size of R&D, clinical and manufacturing facilities. A near tripling of cellular/gene therapy cleanrooms sales/revenue is expected over the next five years, with further acceleration of market size and share and installed cleanroom space through the next 10 years (2030).

Market by geographic region

North America, particularly the U.S., accounts for the largest share of the cleanroom market due to the presence of the largest number of pharma and biopharma R&D and manufacturing facilities. However, Asia-Pacific will be witnessing the fastest growth during the forecast period (2019-2025), but is starting from a very low baseline.

Overall, the market share or portion of revenue from major market countries, particularly the U.S. and Europe, will be slowly decreasing as sales increase in other parts of the world, with highest growth in Asia.

Market drivers

There are a number of factors and trends contributing to overall growth in the cleanrooms market:

- Growing bio/pharmaceutical markets

- Pre-fab/POD types address shortage of skilled labor and related high costs

- More and more stringent regulatory standards

- Increasing usage of modular cleanrooms in contract manufacturing

- Rising adoption of modular cleanrooms in the biopharma industry

- Growing demand for precision/personalized medicine (cellular and gene therapies)

- Rise in orphan pharmaceutical development, with more products in development

- Increase in the need of reliable delivery times and cost budgets drive pre-fab/POD types

- Developing regions offer new growth opportunities

- Decreasing cost of modular cleanrooms, providing increased competition with the stick-built, almost always custom, cleanrooms

Market share by type

As the original technology, stick-built designs and constructions continue to be the primary type of new installation. Stick-built cleanrooms are currently the market share leader, and account for about 85 percent of worldwide pharmaceutical cleanrooms in operation, while modular/PODular are about 15 percent in terms of in-place cleanrooms. There is an ongoing trend for increased modular and pre-fab/POD sales, as the industry, particularly the biopharmaceutical industry, realizes the technological and operational advantages of these products versus stick-built. Increasingly, biopharmaceutical facilities moving away from stick-built construction for new installations, and toward modular or pre-fab cleanrooms.

The increase in modular and pre-fab/POD-type sales is due to rising preference among customers for more flexibility and adaptability of their cleanrooms, with costs for stick-built and modular now rather similar, and the industry recognizing the long-term use and contamination (e.g., mold) problems with stick-built. Modular and pre-fab/POD-type cleanrooms provide diverse advantages, including increased flexibility, such as can be adapted for manufacture of different products, and speed (time to coming online), and are increasingly being selected where costs are similar or total cost of operation is taken into consideration. In some countries, such as India and Ireland, regulations essentially favor use of modular cleanrooms or pre-fab/POD-type cleanrooms.

Pre-fabricated cleanrooms, including PODs, currently have and will increasingly see the highest growth among the different types of cleanrooms. Much of this involves taking sales that would otherwise go to stick-built. In specialized applications/needs, such as need to rapidly clone manufacturing facilities in various parts of the world or need to provide domestic manufacture of products such as vaccines where developing countries insist on this, there is sometimes little choice other than pre-fab/PODs.

According to BioPlan’s research, the market may currently not fully understand much of the benefits of PODular cleanrooms. These include pre-fab/POD-type cleanrooms in many respects being even more flexible than modular rooms, are prequalified before these enter the site, and are delivered much faster, besides also being more repurposable, movable and even sellable, as needed.

Modular/podular: the next trend after single-use

According to BioPlan’s 16th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity,1 the next step in bioprocessing evolution will likely be toward modular and podular bioprocessing units; compartmentalizing and sealing unit process equipment, such as increased use of isolators and RABs. Major biopharma manufacturers are just starting to adopt modular facilities, exemplified by GE building a fully modular plant for Pfizer and G-CON’s POD infrastructure for Just, an integrated design company focused on biotherapeutics in China. Enclosing bioprocessing equipment within their own isolator cabinets or enclosures or even free-standing buildings can significantly reduce risks of contamination and costs, including allowing use of cheaper, lower grade cleanrooms housing this equipment.

Companies including GE Healthcare bioprocessing units (being acquired by Danaher) and G-CON are marketing modular or podular bioprocessing units, often including fixed installed equipment when possible within a portable self-enclosed trailer or other deliverable room-sized cleanroom. Another benefit of the pre-fab/POD structures is the fact that these can be re-used and/or moved to a different location. Stick-built structures can typically only be used for one product lifecycle, pre-fab/PODs can be refurbished and re-used. In general, the traditional core structure will remain permanent while the equipment housed in modular units will generally be single-use, while more mobile podular units may be moved to other process lines or facilities. True mobility of modular/podular bioprocessing units is more relevant to applications, such as biodefense and epi/pandemic vaccines manufacturing, where needs are dire for rapid manufacturing responses and these needs may be transitory, such as until an epidemic is under control. After or in-between use these mobile units can be fully sanitized by vaporized hydrogen peroxide.

In BioPlan’s recent survey, we asked bioprocessing facilities to identify on which innovative technology areas vendors should focus their R&D.1 Bioprocessing decision-makers noted they wanted to see more “modular construction for bio facilities,” albeit at a continued lower percentage (5 vs. 8.8 percent in 2018) than in previous years.

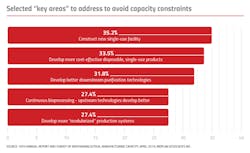

We also ask respondents to identify key areas to address to avoid capacity constraints. In 7th place was “develop more modularized production systems.” Here, 27.4 percent of respondents indicated this as among the top 10 areas to address, up from 26 percent in 2018.

Selection factors for modular cleanrooms

The cost effectiveness of modular/pre-fab cleanrooms largely varies based on the magnitude of space, prequalification activities and documentation and type of facility. Modular/pre-fab cleanrooms typically provide modular components with more standardized packages, which cost more than stick built but reduce field installation labor cost and hidden costs, like temporary parking etc. Modular/pre-fab cleanrooms also tend to house more single-use-based bioprocessing. Modular/pre-fab construction is accomplished by the engineers in a factory environment. Such controlled conditions on the manufacturing floor generally deliver higher quality and more reproducible results which often far exceed those obtained by traditional stick-built cleanroom that are finished at the construction site. Since the units are build off-site, delivery times are kept as manufacturing activities can be ramped up by shift work. This factory-based construction methods deliver precise and fully compliant systems while also offering customization and adaptability. The advantages of modular system are increasing the demand for and shifting the trend towards modular systems, with this shift or trend already evident in most major markets.

Some of the factors we identified influencing the selection of the modular design:

- Quality of the cleanroom materials; GMP suitability

- Ease of construction with less disruption

- Quicker turnaround; validated process lines coming online sooner

- Adherence to regulatory and quality requirements

- Economic viability/cost-effectiveness

Selection factors for pre-fab/POD type cleanrooms:

- Delivery of a pre-qualified, fully functional cleanroom unit

- Scaling of manufacturing space without interruption of existing processes

- Fast and reliable delivery times

- Possibility of cloning the cleanroom infrastructure and abbreviating redesign and qualification needs

- Movable, repurposable cleanroom asset; even resellable, if needed

- Adherence to regulatory and quality (including fire protection and environment-friendly) requirements

- Economic viability/total cost ownership-effectiveness

The adoption of modular/podular cleanroom technologies in developing regions is accelerating and also adopted by large pharma. In India and China the adoption remains low, due to financial constraints, with the cheapest option being locally selected, generally stick-built. Chinese, Indian and other cleanroom companies are providing lower cost products in this market, but the quality of these products is often lower than from other manufacturers and may not meet the regulatory standards. Otherwise, worldwide there is an increasing pressure among the established modular and podular suppliers to deliver finished product, as the overall market continues to expand.

16th Annual Report of Biopharmaceutical Manufacturing Capacity and Production, BioPlan Associates Inc. April 2019.