The radiopharmaceuticals vision — and the next-gen companies seeing it through

For 125 years, the phenomena of radioactivity has captured the attention of the scientific community, illuminating a seemingly endless world of medical possibility.

Spurred by the discovery and subsequent widespread X-ray experimentation craze in the late 19th century, famous names in science, including Henri Becquerel and Pierre and Marie Curie, ushered in an era of radioactive exploration.

Shortly after the Curie duo isolated and named radium, science recognized its potential in cancer treatment. Once the radium floodgates opened, it was difficult to contain the outpouring of enthusiasm for the new ‘medical miracle’ and radium was examined as treatment for everything from diabetes to pneumonia to impotence.

But a ride on the radium bandwagon came with a steep ticket price. While scientists were quick to realize the medical benefits, they were slower to comprehend radiation’s serious and sometimes fatal effects. Both Curies endured radiation sickness, and Marie’s death from aplastic anemia was attributed to radiation exposure. Becquerel died suddenly of ‘unknown causes’ not long after his discovery of radioactivity, with severe radiation burns on his skin.

Yet the half-life of science’s love for radioactivity proved robust, and rather than abandon the dream, the world found safer ways to source, handle and utilize radiation.

In the early ‘90s, drug developers were busy pursuing the promise of precision medicine through monoclonal antibodies. At this point, radiopharmaceuticals were mostly relegated to imaging and diagnostic tools, but a handful of drug developers began exploring a niche area of cancer treatment by linking mAbs to radioisotopes — using the mAb to deliver radiation treatment directly to cancer cells.

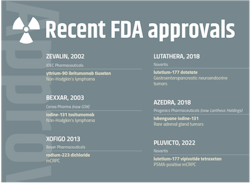

By 2003, the first two antibody-directed radiotherapies — IDEC Pharmaceuticals’ Zevalin and Corixa Pharma’s Bexxar — had won Food and Drug Administration approval. Although clinically effective against non-Hodgkin’s lymphoma, the drugs struggled with regulatory delays, manufacturing issues and general infrastructure challenges. Corixa, laden with debt and unable to recover from Bexxar’s market flop, sold the company to GSK, who ultimately yanked Bexxar from the U.S. market. Zevalin changed hands several times and after sales plummeted to just a few hundred patients per year, it was Spectrum Pharmaceuticals that pulled the plug.

These early therapies became cautionary tales in a nascent radiopharmaceuticals space. While the learning curve for therapeutic radiopharmaceuticals was far less fatal than it was for radiation a century ago, it was no less treacherous. And yet, the allure of these treatments continued to burn bright in cancer care.

“When we entered this space in 2019, we understood the potential challenges of entering into the radiopharmaceutical ring, and yet we also were completely entranced by the promise of being able go into a brave new world of cancer treatment — and this commitment has been justified as the field is now massive with an explosion of interest,” says Thomas Harding, executive vice president and chief scientific officer at Clovis Oncology.

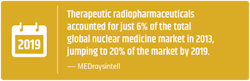

With a market estimated to exceed $13 billion by 2030 and a space lit up with acquisitions, new company launches and clinical trials, therapeutic radiopharmaceuticals have gone mainstream. And this new generation of radiopharmaceutical companies is stacked with experienced experts who are laser-focused on correcting the missteps and misfortunes of earlier pioneers.

Now, by tackling the uniquely complex development, manufacturing and supply chain concerns, players in the therapeutic radiopharmaceutical space are positioning themselves to revolutionize the future of oncology.

Going mainstream

Clovis Oncology’s journey into radiopharmaceuticals started with ‘the one that got away.’

The Colorado-based company was founded in 2009 with a focus on precision cancer treatment, initially through poly (ADP-ribose) polymerase (PARP) inhibitors. Five years ago, Clovis bid on an early-stage drug, PSMA-617, that, while being studied as a diagnostic tool for prostate cancer, had accumulated ample compassionate use data demonstrating its efficacy as a therapeutic.

“It was a diamond in the rough,” recalls Harding. “Most traditional pharma companies had completely overlooked it. And that’s probably because it lived in a unique space.”

But a lot was about to change for PSMA-617 and for therapeutic radiopharmaceuticals in general.

Ultimately, it was Endocyte that put up the winning bid for the asset in October of 2017, obtaining the rights to develop and commercialize the injectable drug that targets diseased cells with the beta-emitting radioisotope, lutetium-177.

Most know how this story ends: A year later, Novartis inked a $2.1 billion deal to acquire Endocyte and the phase 3-ready therapy. The drug, now blockbuster-hopeful Pluvicto, was approved by the FDA to treat metastatic castration-resistant prostate cancer (mCRPC) this past March.

Clovis found its opening in radiopharmaceuticals a year later, entering into a collaboration with German biotech, 3B Pharmaceuticals. The deal gave Clovis the rights to an IND-ready fibroblast activation protein (FAP)-targeted radiopharmaceutical therapy, as well as a discovery program for additional targets.

“I think what you have witnessed in the last few years is companies bringing these kinds of drugs into more mainstream clinical development — and working through the rough edges,” says Harding. “The field has gotten enormous and it’s great to be at the front of this emerging wave of therapeutics.”

Many market analysts point to the move Novartis made just prior to snatching up Pluvicto — a $3.9 billion deal to buy Advanced Accelerator Applications and its peptide receptor radionuclide therapy branded as Lutathera — as the watershed moment for modern therapeutic radiopharmaceuticals. When Lutathera was given the go-ahead by the FDA in 2018 for the treatment of neuroendocrine tumors affecting the pancreas or gastrointestinal tract, the approval highlighted the broad potential of radioisotopes to target solid tumors.

“Recent promising trial results reporting remarkable tumor shrinkage without significant side effects is leading to the beginning of a new major class of cancer treatments,” says Renu Bala, senior analyst at Citeline. “The number of positive trials, added to the broader commercialization of radiopharmaceuticals, are providing a precedent for others to follow.”

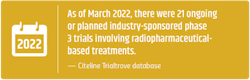

According to Bala, more radiopharmaceutical trials were initiated in 2021 (80) than ever before — an upward trend that has been consistent since the beginning of the last decade. As of March 2022, Citeline’s Trialtrove database identified 1,104 trials that involve radiopharmaceutical-based treatments. According to the Pharmaprojects R&D database, the pharma industry has ~60 investigational radiopharmaceutical therapies in various stages of development.

As these new drugs race towards commercialization, industry eyes are watching closely to see if modern radiopharmaceutical companies can work through the kinks of therapies past and advance what many are viewing as the next pillar in oncology.

Don’t decay

While time is typically a factor in pharma manufacturing, speed becomes a non-negotiable need when working with radioactive substances.

In a quest for stability, atoms with an unstable nucleus shed excess energy in the form of radiation. This shedding process — radioactive decay — is measured in a time period known as half-life. A radioisotope’s half-life is the time it takes one-half of its atoms to decay. While this time can range from less than a second to billions of years, most of the radioactive isotopes used in pharma have a half-life of just a few days. Two commonly used isotopes, lutetium-177 and actinium-225, have half-lives of 6.7 days and 9.92 days, respectively.

“They are like melting ice cubes — time is of the essence,” says Kevin Staton, vice president, CDMO Project Management, Evergreen Theragnostics. “Once the isotopes are in hand, it’s a well-defined quick series of processes that have to happen.”

A New Jersey-based specialty CDMO, Evergreen opened the doors to its 14,000-square-foot facility this past fall, in anticipation of the pharma industry’s expanding unmet need for these types of radio-friendly facilities.

While working on early-stage clinical projects at his previous position at Memorial Sloan Kettering, Staton had witnessed the industry’s need for dedicated manufacturing facilities.

“While at MSK, we heard of numerous issues when companies we partnered with tried to work with radiopharma CDMOs after working with us. These issues spanned from technical limitation to a general unwillingness to adapt the process,” says Staton. “Evergreen and other CDMOs in the space have gained experience since those days to help ease these types of issues.”

A radiopharma manufacturing facility and its workflow must be designed to accommodate not just a rushed timetable, but also a host of other unique considerations that come with radioactive substances. Meeting all these expectations for Evergreen’s cGMP-compliant facility was no small task, but Staton credits close collaboration between the design and engineering firm, contractors and the Evergreen team — all of which had radiopharma facility experience.

In addition to meeting the FDA’s cGMP requirements, facilities that manufacture radioactive drugs or materials must be certified by the U.S. Nuclear Regulatory Commission (NRC). In most states, like New Jersey, NRC’s authority is transferred to the state’s department of environmental protection. In Staton’s experience, this Radioactive Materials (RAM) license application process usually takes anywhere from 6 months to a year.

And the process is ongoing — after the initial site inspection, facilities can be audited, unannounced, at any time.

Facilities require specialized equipment — much of Evergreen’s equipment is custom designed and shipped from a radiopharmaceutical equipment supplier in Italy. Isolator technology is utilized to prevent accidental contact, inhalation or ingestion. Most of the equipment is encased behind lead to minimize operator exposure, and the added weight makes it difficult to move and warrants a sturdy concrete support system underneath.

Most importantly, because both speed and safety are paramount, the relationship between spaces and equipment, as well as the flow and containment in the facility must be carefully considered from the start.

Locking down the supply chain

All these special considerations of course come at a cost — which means that for many drug developers, in-house manufacturing of radiopharmaceuticals is impractical from both a business and strategic standpoint.

“If you look at the cost of setting up your own manufacturing facility, I think there will always be aspects of the process that we will outsource,” says Harding. “Because of the amount of complexity involved, our preference is to partner with CDMOs who have fully committed to the radiopharma space.”

Clovis has outsourcing agreements with Evergreen as well as with Ontario-based Centre for Probe Development and Commercialization (CPDC) for its pipeline of targeted radionuclide therapies — both CDMOs specialize exclusively in radiopharmaceuticals.

Currently, the radiopharma CDMO market is somewhat fledgling, but new companies — like Evergreen — are beginning to pop up. When it comes to North American CDMOs who can handle end-to-end (pre-clinical through commercialization) radiopharmaceutical work, Staton estimates there are less than half a dozen options at present.

While the industry is currently not experiencing capacity restraints, for some companies, the potential future shortage of CDMOs in the space is a risk not worth taking.

Indianapolis-based POINT Biopharma was launched in 2019 with the mission of making lifesaving radiopharmaceutical treatments available to more patients by solving the historical challenges that blunted the success of earlier therapeutics. The next-generation company is led by a management team packed with radiopharmaceutical veterans with firsthand experience of past supply chain constraints. POINT’s strategy for success in radiopharmaceuticals involves internalizing as many steps in the supply chain as possible.

“Reliability is in our DNA,” says Joe McCann, chief executive officer of POINT Biopharma. “POINT’s platform was designed from inception with a focus of ensuring the reliable delivery of next-generation radiopharmaceuticals.”

POINT, whose lead candidate is currently in phase 3 trials for metastatic castration-resistant prostate cancer, has its own 80,000-square-foot facility currently supplying doses for clinical trials and equipped to handle large commercial volumes when the time comes.

The volatile nature of radiopharmaceutical therapies means that a single glitch can send the entire supply chain into a tailspin — which can end with patients not getting the lifesaving treatments that were made-to-order for them specifically.

“Radioactivity is being lost by the second — a dose made on Tuesday may need to be injected on Wednesday — the process can’t afford even the slightest delay,” says Staton.

One needs to look no further than the recent Novartis shutdowns to illustrate that even pharma giants with their own in-house manufacturing are not impervious to the complexities of radiopharmaceuticals.

Back in May, Novartis suspended production of Lutathera as well as freshly-approved Pluvicto at two of its radioligand therapy production sites — one in Italy and one in New Jersey. For almost two months, the “potential quality issues identified in its manufacturing processes” stopped Novartis’ deliveries in the U.S. and Canada as well as brought clinical trials to a screeching halt. Novartis later announced the expansion of both facilities, as well as a plan to build a new radioligand manufacturing plant in Indiana that will be operational in 2023.

Both small and large companies in the space have realized that the single most important aspect in the supply chain is redundancy.

“You need to have your supply chain complexity completely locked down to do this properly. The name of the game is redundancy — you need systems in place in case anything fails,” says Clovis' Harding.

Sourcing the power

Medical isotopes, the source of radiopharmaceuticals’ tumor-destroying power, are a vital piece of the supply chain.

In order to create these modern therapeutics — which McCann aptly describes as ‘cancer-seeking missiles’ — radioisotopes are linked to a cell-targeting molecule, such as a monoclonal antibody, small molecule or peptide. When injected into the body, the radioisotopes are delivered to the tumor, emitting high-energy particles that damage the tumor cells’ DNA, killing the cells.

While there are thousands of known radioisotopes, not all of them are suited for therapeutics — and choosing the right isotope is key to the success of the radiopharmaceutical drug.

“Utilizing the best isotope for the job is a core philosophy at POINT,” says McCann.

According to McCann, there is a narrow group of characteristics — referred to as ‘goldilocks properties’ — which makes a radioisotope valid for use in therapeutics. The isotopes must: be commercially available, have a medically useful half-life, have an emission type that is suitable for treatment, and demonstrate appropriate energy transfer — meaning the energy associated with particles being released from the nucleus will damage tumor cells.

Drug developers are left with a short list of isotopes — about half a dozen — ideal for therapeutic use.

Lutetium-177 — which is a beta emitter, meaning it emits radiation in the form of negatively charged beta particles — currently has the lion’s share of presence in clinical trials. Both of Novartis’ approved drugs, Lutathera and Pluvicto, also rely on lutetium. But lutetium isn’t the only game in town — the therapeutic efficacy of actinium-225, an alpha-emitter, is attracting clinical attention as well.

These more modern isotopes are safer to work with and easier to deliver to patients, primarily because they emit lower levels of gamma radiation. During the process of natural radioactive decay, in addition to alpha and/or beta particles, some isotopes also emit gamma rays. Gamma radiation is the most penetrative type of energy currently known — and because it can pass right through the human body — arguably the most dangerous. To their detriment, early radioactivity pioneers, including Becquerel and the Curies, worked with high levels of gamma radiation with no protective measures in place.

Most radioisotopes used in therapeutics today are produced using neutron activation in nuclear reactors. Radioisotope suppliers source their isotopes from a few nuclear reactors around the world. According to the World Nuclear Association, most of these reactors are over 50 years old, which means there is an ongoing risk that they could break down and temporarily be taken offline.7

The growing popularity of certain isotopes combined with the limited number of nuclear reactors, as well as the ultra-rare input materials and complex purification processes needed to make radioisotopes, means that isotope supply has been and remains top of mind for those in the radiopharma space.

“The supply chain is different for each isotope. Currently, actinium-225 is in high demand but supply has not been able to keep up. A number of companies are working on expanding supply, but they are still 2-3 years away from making a substantial dent in this demand/supply gap,” says Staton.

The medical isotope industry has sprung into action, and efforts are underway to develop more efficient production methods, as well as improved reactor and purification technology. New suppliers, such as Isogen — a Canadian joint venture between Framatome and Kinectrics — are launching to strengthen the supply.

“Everyone has realized this is a major limitation, so you have all these new isotope supply companies coming online to meet those demands,” says Harding. “If you look at the projections, I think the industry will solve the lutetium and actinium supply issues within the next five years.”

The radioisotope for GSK’s Bexxar, iodine-131, came from Canadian supplier, MDS Nordion. Nordion was relying on an aging nuclear reactor in Ontario, which at one point was shut down for over a year. To make matters worse, on more than one occasion, Bexxar’s isotope supply was disrupted by snowstorms.

Keeping these past glitches in mind, POINT is unwilling to risk an isotope shortage and has extended its self-reliant philosophy to its isotope supply chain. The company is in the process of building capabilities to make lutetium-177 in-house, to not only ensure supply resiliency but also lessen isotope loss due to decay during transport.

A targeted future

While the dream of radiopharmaceuticals is much broader, at present, applications for therapeutics are limited to certain types of cancer.

In the U.S., marketed products target two popular indications: neuroendocrine tumors (Progenics’ Azedra and Novartis’ Lutathera) and metastatic castration-resistant prostate cancer (Bayer’s Xofigo and Novartis’ Pluvicto). Zevalin and Bexxar, which are no longer available in the U.S., were both approved for non-Hodgkin’s lymphoma — another area where radiopharmaceuticals have seen success.

Bala, citing recent Trialtrove data, points out that 19 of the top 20 most studied indications for radiopharmaceuticals are in oncology (the one exception being pain relief in central nervous system disorders). The majority of trials are focusing on non-Hodgkin’s lymphoma and prostate cancer.

Prostate cancer has been a popular target because its cancer cells have high prostate-specific membrane antigen (PSMA) levels. About 95% of this protein rests on the surface of the prostate cells. The external location of PSMA and the fact that it is over-expressed in the vast majority of prostate cancers, but very limited on normal tissues, makes it ideal for treatment by radiopharma therapeutics.

Prostate cancer is the second most common cancer among men, with an estimated 1.4 million people diagnosed globally each year. If radiopharmaceuticals were to become the standard of care, the potential market is extensive.

Approved drugs, such as Pluvicto, are currently used after a patient’s prostate cancer has failed to respond to other anticancer treatments, such as chemotherapy. The future hope is to also be able to apply radiopharmaceuticals earlier in the disease cycle, perhaps before the prostate cancer has metastasized — and trials testing this are already underway.

Although prostate cancer is currently a popular indication, theoretically, these targeted therapeutics could be applied to almost any malignancy — and several companies have set out to prove the technology’s pan-cancer potential.

Pan-cancer clinical trials, such as POINT’s FRONTIER trial and Clovis’ LuMIERE trial, could provide the breakthrough that brings radiopharmaceuticals to a variety of high-volume indications — both as a monotherapy or in combination with other treatments.

“Drug candidates like PNT6555 from POINT’s FRONTIER trial could exponentially increase the number of patients which could benefit from radiopharmaceuticals,” says McCann.

Both POINT and Clovis are investigating treatments that target fibroblast activation protein (FAP). FAP is highly expressed in the cancer-associated fibroblasts found in the majority of cancer types, making it a suitable target across a wide range of tumors.

POINT’s phase 1 FRONTIER trial, which began this summer, will evaluate pipeline therapy [Lu-177]-PNT6555 in patients across five FAP-avid cancer indications: colorectal, pancreatic, esophageal, melanoma, and soft tissue sarcoma.

In a world where more than 10 million people die of cancer each year, therapeutic radiopharmaceuticals are poised to offer another powerful option in the arsenal of treatments for common cancers, as well as new hope in cancers that have historically been resistant to other types of treatment — and given the surge of activity in the reinvigorated space, this realization may not be far off.

“For most of their existence, therapeutic radiopharmaceuticals have been limited to small, orphan indications,” says McCann. “The capability of delivering radiation directly to a wide variety of cancers could revolutionize cancer treatment paradigms.”

About the Author

Karen P. Langhauser

Chief Content Director, Pharma Manufacturing

Karen currently serves as Pharma Manufacturing's chief content director.

Now having dedicated her entire career to b2b journalism, Karen got her start writing for Food Manufacturing magazine. She made the decision to trade food for drugs in 2013, when she joined Putman Media as the digital content manager for Pharma Manufacturing, later taking the helm on the brand in 2016.

As an award-winning journalist with 20+ years experience writing in the manufacturing space, Karen passionately believes that b2b content does not have to suck. As the content director, her ongoing mission has been to keep Pharma Manufacturing's editorial look, tone and content fresh and accessible.

Karen graduated with honors from Bucknell University, where she majored in English and played Division 1 softball for the Bison. Happily living in NJ's famed Asbury Park, Karen is a retired Garden State Rollergirl, known to the roller derby community as the 'Predator-in-Chief.'