Solid Dose: Under-hyped but not under-represented

Tablets may not be as glamorous or cutting-edge as emerging sectors of the biologics markets, but they have their upsides. Oral solid dose formulations are efficient and cost-effective to manufacture, shelf stable and easy to administer. Perhaps most importantly, they are understood and accepted by patients worldwide.

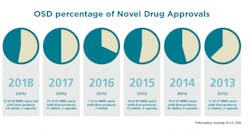

Pfizer led the OSD charge in 2018 with four novel drug approvals. These approvals included: Daurismo (November 2018) to treat newly diagnosed acute myeloid leukemia in adult patients; Lorbrena (November 2018) to treat patients with anaplastic lymphoma kinase-positive metastatic non-small cell lung cancer; Talzenna (October 2018) to treat locally advanced or metastatic breast cancer patients with a germline BRCA mutation; and Vizimpro (September 2018) to treat metastatic non-small-cell lung cancer.

If market predictions are your jam, Future Market Insights projects the global OSD pharmaceutical formulation market to grow 6.5 percent CAGR from 2017 to 2027. In terms of revenue, the market is projected to jump from $500,000 million in 2017 to over $900,000 million in 2027. North America will remain the largest market for OSD formulations, followed by Asia Pacific (excluding Japan) and Western Europe. Revenue from the North America market alone is expected to surpass $300,000 million by the end of 2027.

By dosage form, tablets will continue to remain preferred in the market, with sales estimated to surpass $500,000 million by the end of 2027. Capsules are expected to be the second most lucrative dosage form in the market. Of the 59 NMEs approved in 2018, 24 were tablets and seven were capsules.

If real-life action means more to you than market predictions, drug manufacturers — even those who are investing in biologics development — continue to expand their traditional solid dose processing businesses.

In recent news, CDMO giant Catalent, fresh off a $1.2 billion gene therapy deal with Paragon Bioservices, announced that it is investing up to $40 million at its manufacturing facility in Winchester, Kentucky to increase formulation and controlled-release tablet and capsule manufacturing capabilities and capacity.

“We have a clear investment strategy at the site that is not only driven by immediate customer needs, but also looks to the future in anticipation of demand and new technologies,” said Rick Tucker, general manager for Catalent Winchester.

Last August, Boehringer Ingelheim broke ground on what it is calling its “Solids Launch facility” at its tablet production site in Ingelheim, Germany. The facility will open in 2020. In April of last year, Mayne Pharma’s CDMO business, Metrics Contract Services, opened a new $80-million oral solid dose commercial manufacturing facility in Greenville, North Carolina. Last February, generic-drug manufacturer Amneal Pharmaceuticals announced plans to expand its solid dose and softgel manufacturing plant in Long Island, New York.

Opportunity for solid dose forms is being driven by new drug formulations. Recent research has focused on controlled drug delivery, which offers definite advantages over a conventional release formulation of the same drug. Controlled release versions of solid dose drugs can reduce the dose frequency and provide more uniform drug delivery. This can ensure safety and improve the efficacy of drugs, as well as increase patient compliance. New formats for OSD drugs, such as bi-layer tablets, have become increasingly popular, enabling controlled delivery of different drugs with pre-defined release profiles.

Additional improvements have been made in areas such as bioavailability, taste masking and chemical stabilization, further securing the OSD’s place in the market. As the sector continues to enhance its process understanding, the market will see higher quality, more effective and more evolved solid dose products.

About the Author

Karen P. Langhauser

Chief Content Director, Pharma Manufacturing

Karen currently serves as Pharma Manufacturing's chief content director.

Now having dedicated her entire career to b2b journalism, Karen got her start writing for Food Manufacturing magazine. She made the decision to trade food for drugs in 2013, when she joined Putman Media as the digital content manager for Pharma Manufacturing, later taking the helm on the brand in 2016.

As an award-winning journalist with 20+ years experience writing in the manufacturing space, Karen passionately believes that b2b content does not have to suck. As the content director, her ongoing mission has been to keep Pharma Manufacturing's editorial look, tone and content fresh and accessible.

Karen graduated with honors from Bucknell University, where she majored in English and played Division 1 softball for the Bison. Happily living in NJ's famed Asbury Park, Karen is a retired Garden State Rollergirl, known to the roller derby community as the 'Predator-in-Chief.'