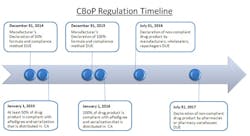

The close-out of 2012 initiates the 24-month countdown to the California Board of Pharmacy’s (CBoP) manufacturer deadline for Article 5.5 on ePedigree and serialization requirements. These regulations will be affecting many nodes of the pharmaceutical supply chain, starting with the manufacturer down through the packager, wholesaler, distributor and final dispensing entity. The regulation requires that all “dangerous drugs,” defined as drugs unsafe for self-use, which are distributed in California, be serialized and have an electronic pedigree. For the purpose of clarifying this regulation, the CBoP definition of “dangerous drug” is synonymous with the FDA’s definition of “prescription drug.”

Implementing the “right” solution for your company will demand an all-hands-on-deck coordinated approach by the internal and external stakeholders in your supply chain.

Driving Purpose

The driving purpose of this proposed legislation is to prevent counterfeit drugs from entering the California supply chain, distribution network, and consumer market. In recent years there has been an increasing amount of counterfeit drugs entering the U.S. consumer market, offering non-FDA approved and potentially substandard or even harmful products fraudulently marketed using the legitimate pharmaceutical brand name but at lower prices. These lower prices have been attracting the unsuspecting, unscrupulous or greedy pharmacist/dispensary. Federal and state law enforcement have found this to be a growing and endemic problem. Recent cases include Allergan’s Botox and the cancer drug, Avastin®, both of which were being sold by a foreign supplier operated by Canada Drugs. In an effort to increase accountability, the FDA has posted the names of the doctors that knowingly purchased the non-FDA approved foreign Botox.

There is a lot of discussion about why the CBoP is requiring the ePedigree versus another method (such as authentication). The ePedigree provides an ‘audit trail’ (documented evidence) that in theory could help to identify and catch a “bad actor” in the supply chain. The ePedigree requires “a certification under penalty of perjury from a responsible party of the source of the dangerous drug that the information contained in the pedigree is true and accurate.” There are some that think the ePedigree will put a burden on the good actors in the supply chain and not stop the bad actors that are using methods such as internet pharmacies to sell counterfeit drugs.

While there is no specific penalty/fine written into the proposed language of this regulation to-date, there are two possible scenarios to note. First, California 2012 Lawbook for Pharmacy defines penalties per offense for violation of pharmacy law. Article 20.4321 states, “any person who knowingly violates any of the provisions of this chapter, when no other penalty is provided, is guilty of a misdemeanor, . . . shall be punished by a fine of not less than two hundred dollars ($200), and not more than two thousand dollars ($2,000), or by imprisonment of not less than 30 days nor exceeding six months, or by both.” Second, a 2008 draft of California pedigree law, while not currently valid, stated specific penalties for violating pedigree law. This draft, if implemented, would fine the manufacturer $5,000 per saleable unit not having sufficient records to prove compliance, or having a fraudulent pedigree.

How to Begin

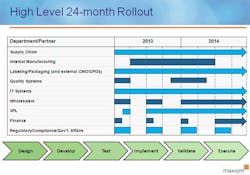

To start, put together an internal project team with representatives from each stakeholder department, including: supply chain, manufacturing/contract manufacturing, packaging/graphics, regulatory/government affairs/compliance, distribution/3PL, information technology/data management, wholesalers/customers, finance, and quality. This coordinated effort needs to have buy-in across the company and supply chain. Keys to success for being compliant at each timed phase of this regulation will be the ability to anticipate the complexities, allocate necessary resources, and allow enough time to get the serialized product into the distribution channel by both the January 1, 2015 and 2016 deadlines.

There are two big strategy questions that need to be decided early. One, how are we going to define the initial 50%, or which products do we want to serialize first to comply with the January 1, 2015 deadline? And two, how do we want to serialize our unit packages “in-line” or “off-line?”

The January 1, 2015, deadline represents the first significant milestone of this regulation, and it solely applies to manufacturers. Manufacturers must have 50% of their drug product serialized and with ePedigree. The regulation allows the manufacturers to choose which 50% of product is compliant, based on three measurement methods: “(i) unit volume, (ii) product package (SKU) type, or (iii) drug product family.” The freedom to choose a method allows for some strategic decision making. When choosing the 50%, consider the following: patent timelines (on or off), internal and external production, volume levels, whether there is available real estate on the package for the unique number/barcode, etc.

With limited manpower and resources, the CBoP aims to place accountability on the manufacturers by making them responsible for identifying which product is compliant so that they police themselves. For each January deadline, manufacturers must submit, by December 31st of the previous year, an official declaration that details which 50% of their product was chosen for serialization and by what technology it was serialized. Specifically, the regulation states that the declaration must include:

• “A list and quantity of dangerous drugs by name and product package (SKU) type representing at least fifty (50) percent of the manufacturer’s total that are ready for initial implementation of the serialized electronic pedigree requirements as of January 1, 2015;

• A statement identifying which one of the following methods was used to measure the percentage of drugs ready to be serialized: (i) unit volume, (ii) product package (SKU) type, or (iii) drug product family;

• A statement describing the calculation(s) used to arrive at the percentage figure of dangerous drugs ready for serialized pedigree requirements;

• A list and quantity of dangerous drugs by name and product package (SKU) type that are in the remaining percentage not yet ready to be serialized or subject to pedigree requirements; and,

• A statement specifying the technology employed to meet the pedigree requirements, including but not limited to any platform(s), vendor(s), hardware, software, and communication technologies deployed.”

Other Implications

Packaging: There are many decisions to be made here. A best case scenario is when building a new packaging line the company makes it “serialization ready;” otherwise, it is necessary to retrofit the existing line. It is a big help if you have a packaging line (or partial line) that can be used for prototyping, because one of the major issues is getting line-time to implement and validate the serialization functions when the line does not have much downtime.

Data System: The system used on the packaging line must then send the serial numbers for the packaging hierarchy to a data system that can store this information. Some pharmaceutical companies are known to use SAP Aii (auto id infrastructure) for this purpose. The system that is storing the serialization hierarchy also needs to be able to handle (or interface with) the needs of exception handling, and distribution and warehouse movements. Exception handling includes several types of movements, for example: rework, removing cases from a pallet, removing units from a case, etc. The requirements of warehouse movements typically focus on inventory adjustments and shipments to customers. This means tracking all of the serial numbers and creating new packaging hierarchies as the materials are shipped or moved to new containers.

Communicating with Trading Partners: Manufacturers need to follow the California pedigree regulations, but also need to be involved in industry groups and discussions with trading partners to determine requirements for communicating serialized data. For example, many wholesalers are requesting a serialized ASN (logistics), in addition to the ePedigree (legal). Additionally, there is much conversation in the industry about how the ePedigree should be delivered – there is the DPMS (drug pedigree messaging standard), which meets the California pedigree requirements and the newer network centric pedigree models. DPMS is a document based method (XML document with digital signatures), which will require huge amounts of data storage.

Network centric models for handling the pedigree hope to reduce the data burden and make handling the pedigree easier, but these models have yet to demonstrate the ability to ‘certify’ the pedigree; although, there is a lot of activity in industry groups and GS1 to try to make this model compatible with the CA regulations.

Validation & Inference: Again, there has been much discussion in GS1 and the industry groups as to what inference is and when it would be allowed. From the manufacturer perspective, it is critical that the electronic data match the physical world exactly. Specifically, what the manufacturer tells the 3PL and trading partners is contained in the shipment must match exactly or there will be problems downstream that may not be discovered until a box is opened or the shipment reaches the final customer. Manufacturers rely on inference in distribution – they will tell the 3PL what to expect based on a serialized ASN and the 3PL will only scan the pallet level on inbound receipt. Therefore, if the manufacturer has provided incorrect data in the ASN, it will probably not be discovered until picking (or not discovered until the customer opens the box if a full case was shipped).

Coordinating with Contract Manufacturers/Packagers: Contract manufacturing and packaging organizations (CMOs/CPOs) will be required to meet the needs of a larger customer base for ePedigree and serialization solutions. To successfully achieve an effective and validated solution, CMOs will need to limit the technologies and system solutions that they implement and offer to their customer base, or else it will make their production lines drastically over complicated. There is a significant amount of design work for the production lines that is involved to satisfy the requirements of the implemented serialization and ePedigree solution. For both the contracted organization and the company to be satisfied, the needs of both parties need to be rationalized and balanced to form a successful compromise that fulfills all requirements. By now larger customers, such as big pharma, will have already leveraged their significant business relationships to try and force their specific systems on CMOs; CMOs will push back, yet are more likely to consider the preferences of early adopters and significant business partners.

It’s clear that California serialization and pedigree legislation will force pharmaceutical manufacturers to initiate and implement a plan of action in 2013 in order to meet the January 1, 2015 deadline. Many large-sized pharma companies appear to be well on their way; however, smaller and mid-sized virtual pharmaceutical manufacturers need to quickly mobilize resources and ramp up implementation. Without robust internal functional groups, smaller pharma should look to their external partners for guidance, as well as other experts and resources in this field.

Ultimately, many questions still remain for the industry and the CBoP’s regulation. Here are a few issues yet to be decided:

• How will the regulation be enforced and serialization monitored by the California Board of Pharmacy?

• What is the definition of an “offense”; is each saleable unit that is un-serialized or without a correct ePedigree considered a single offense?

• Will extensions be given for those companies that are unable to meet the deadlines? Specifically, if a company acquires a new pharmaceutical company in 2014, which has not made any effort to serialize their products, will there be an exclusion or extension for the acquiring company to allow additional time for them to get the new products compliant?

• What is the policy for grandfathering inventory that was brought into the CA supply chain prior to January 1, 2015?

References:

1 Weaver, Christopher. “Illicit Botox Sparks Alert.” The Wall Street Journal. http://online.wsj.com/article/SB10001424127887324731304578193990868029934.html . December 23, 2012.

About the Authors

Bill Connell is Vice President and Supply Chain Practice Leader at Maxiom Group. He brings extensive skill and experience in supply chain strategy, design and business process development at both small and large clients. Bill has over 25 years of industry experience and consulting, most recently as Senior Vice President of Global Supply and Operations at Iroko Pharmaceuticals/Iroko Cardio. Bill has worked on projects including ePedigree, supply chain network design and optimization, contract manufacturer (CMO), third party logistics (3PL) and distributor selection. He received his MBA from the Indiana University of Pennsylvania and his BS from University of Maine. Bill can be reached at [email protected].

William (Bill) McLaury is the Head, Pharma Supply Chain Strategy for Novartis Pharmaceuticals. He is responsible for developing and aligning Pharma Supply Chain strategies globally as an integral part of Technical Operations and for the development of a Supply Chain Academy curriculum. Previously, Bill was Executive Director, Pharma Supply Chain North America for Novartis. He was responsible for the supply of all of Novartis’ branded pharmaceutical products in North America, leading the groups with operational responsibility for production planning, warehousing, transportation, distribution, international trade management and product portfolio management.

Julia Wiest, Senior Supply Chain consultant, provides clients with supply chain project management, supply chain functional expertise and support. Julia comes to Maxiom Group from Johnson & Johnson, where she was a supply chain project coordinator at the Ethicon Inc. medical device franchise. She has a BBA, specializing in Finance, from the University of Michigan and an MBA, concentrating in Supply Chain Management.

To be published in the April 2013 issue of Pharmaceutical Manufacturing magazine.