Since its inception, Pharmaceutical Manufacturing has been surveying its readers annually to get a sense of how they are feeling about their jobs and the usual pressures of being employed by the pharmaceutical industry. We’ve asked about who they are as professionals, where they fit in their organizations and about their attitudes regarding job satisfaction and dissatisfaction. Pharmaceutical Manufacturing 2014 Reader survey continued the tradition asking readers to respond to 23 questions in an attempt to better understand ourselves within the context of the profession and provide a mirror to reflect common themes shared by all those serving the industry in 2014. Response to this year’s survey remained robust; readers did not have to answer every question, but there were generally no less than 360 readers responding to every question in the survey.

Before we jump a little deeper into what respondents are feeling and trends they are being exposed to over recent times, let’s take a quick look at the demographic profile PhM’s responding readers provided by their responses. For the most part, respondents were predominately male (82.7% of 365 responses), a majority ranging in age from 30 to 55 and older, with a Bachelor’s or Master’s degree in either chemical engineering, chemistry, biology or mechanical engineering. Most fill operational roles (66.5% of 367 responses) across manufacturing, quality assessment, plant engineering and R&D categories. A solid 2/3 of respondents hold management roles (have staff to supervise), with the remainder occupying “individual contributor” roles (in the parlance of HR departments of large-scale technical enterprises). For the most part, these folks, and that includes the third of responding women) have been working in the industry from 11 to 20, to more than 20 years (37.1 and 36.5%, respectively) with next largest chunk (11.4%) toiling for Pharma from 7 to 10 years. In other words, most of PhM’s respondents continue to enjoy long-term careers in Pharma, and salaries reflect the career maturity of those responding with most (29.2% of 364 respondents) making salaries between $100,000 and $150,000. For others, 17.1% have salaries ranging from $80,000 to $100,000, 13.8% claim annual salaries over $150,000, 11.35% over $200,000.

READERS INCREASINGLY GLOBAL

Meanwhile, 73.3% of 367 respondents hail from North America, which is lower by about 10 points than 2013. Apparently making up the difference were respondents from other major regions with a five-point bump from India and three-point bump in respondents from China. What kind of companies are our increasingly global respondents working for? Of the 367 respondents, 23.7% work for a “traditional” Big Pharma company, 17.2% at a “small or mid-sized specialty pharmaceutical manufacturer” followed by generics manufacturers (15%), biopharmaceutical manufacturers (9.5%), vendor/solutions providers (9.5%) and contract manufacturers (9%). Consultancies and “other,” which included regulators, academics, OTC makers and excipient manufacturers.

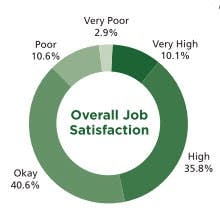

Of all the thingswe queried our readers about, the second highest number (416) responded to rate their level of job satisfaction. Though 40.6% rated their job satisfaction “okay,” 35.8% rated it “high” and another 10.1% rated it “very high.” That left only 13.5% rating it “poor” or “very poor.” What was great, and affirming for the profession is that when asked, “What is most important to you for job satisfaction,” 30.2% selected “challenging work.” Not surprisingly, “salary and benefits” at 23.7% was the next biggest contributor to job satisfaction, followed by “opportunity for advancement” coming in third at 17.5%. Job security, at 13%, was less of a concern in the context of job satisfaction.

What things are making PhM’s readers dissatisfied? For starters, slightly fewer comments were received regarding negative forces impacting job satisfaction. This is often rare, because surveys such as these tend to attract people needing a place to vent their frustrations.

Although PhM’s survey structure and format do not necessarily support statistically rigorous comparisons and subsequently robust trend conjecture, notable is the fact that, among last year’s 398 respondents, 63.1% were concerned with job security while this year (416 total responses) 55.5% were concerned about job security. For those concerned, 114 respondents (50% of the 228 responses to this question) identified “internal cost-cutting measures” as the biggest boogie man when it comes to Pharma personnel’s fears concerning their job security.

IN THE FACE OF CHANGE

Pharmaceutical Manufacturing asked readers, “What are the biggest changes that you have had to face in the past year?” And their responses reflected trends affecting the Pharma universe and the dynamics that are impacting operations, including merger activity, new product introductions and capacity changes. Of the 415 responding, 61.7% felt the biggest change they were facing was “increased workload due to organizational changes,” which to a certain extent reflects the extra work associated with transacting mergers and acquisitions and structural changes to operations in response to recent market forces. Regarding products, 31.6% said that “new product introduction(s)” was the biggest change they were facing, followed by 28.7% dealing with a new role within their organization. In the “other” category, readers could write in what change was affecting them; comments ran the gamut, but “increased regulatory scrutiny” was mentioned several times as was “shutdown of a facility,” and “project disruption due to merger.”

Not surprisingly, when asked directly, “How have market and competitive forces affected your company recently?” respondents (410) replies again reflected major trends impinging change on Pharma’s operations. For example, 50.2% selected “major business unit or operations restructuring as the elephant in the room, followed by 30.5% noting that “new facilities, capabilities in emerging global markets,” were keeping them busy. Garnering similar numbers were “major acquisitions” (29.8%), “closure of underperforming production assets,” (25.1%) and “more outsourcing” (23.4%). In the “other” category, respondents wrote in a variety of things affecting their companies including “lower margins,” “loss of patents,” and on a hopeful note: “sales grew 20%.”