Serialization and related track and trace regulations are now a strategic requirement. For pharmaceutical companies, the supply partners they work with to produce life-saving medicines, and the distribution trade partners that ensure these medicines get to the patients who need them worldwide, track and trace requirements are rapidly becoming a daily part of normal operations in the pharmaceutical supply chain. Propelled by a growing counterfeit drug threat that kills more than 100,000 people annually, regulations for drug serialization, supply chain traceability, and government reporting will affect almost 80 percent of the world’s drug supply by the end of 2018. From the United States and the European Union to China, Brazil, and more, over forty countries will have instituted serialization and other traceability regulations in four short years.

What has been learned by those who have already started? What are the key issues to master in preparing for DSCSA serialization deadlines? And, why should you start now to understand your true readiness timelines and build your strategic plan, particularly in the context of the global regulatory environment?

DSCSA REGULATIONS & TIMELINE

The Drug Supply Chain Security Act’s ten year timetable outlines critical steps to build an electronic, interoperable system to identify and trace prescription drugs from manufacturer to dispenser across the supply chain serving the United States market. Implementation of the forty pages of complex DSCSA regulations can be broken down into three general phases:

• 2015: Lot-level traceability and verification of products and transactions

• 2017-2020: Serialization of drug products and enhanced verification of serialized product identity

• 2023: Unit-level traceability

On the surface, preparing for the 2017 DSCSA serialization deadlines doesn’t seem that challenging – at least in comparison to other global serialization regulations. Pharmaceutical companies and their CMO/CPO partners must generate serial numbers for each saleable unit and sealed homogeneous case of drug product produced. The serial numbers with associated National Drug Codes (NDCs), lot numbers, and expiration dates need to be encoded into 2D data matrix barcodes (for units) and either 2D data matrix or linear barcodes (for cases) following generally recognized industry standards. If you just look upon serialization as “putting numbers on bottles,” it can be very tempting to put off planning for DSCSA serialization. However, it’s more complex than that.

To understand the full complexity of serialization readiness, here are five key issues that pharmaceutical companies need to consider as they build their serialization programs and ask themselves: “When do I need to start?”.

1. Serialization is More than Putting a Number on a Bottle

Current and proposed serialization and barcoding regulations create a complex, strategic data management challenge. While U.S. DSCSA data requirements are fairly straightforward, globally there is a highly diverse serialization ecosystem to contend with:

- Coding: 2D data matrix or linear barcodes may be used incorporating global GTINs or country specific NTINs

- Formats: GS1 standards predominate while China’s EDMC and Brazil’s IUM differ significantly in length and format

- Sources: Manufacturers can create their own serial numbers except in China where they are requested from the government

- Attributes: Serial numbers may be randomized or sequential and uniqueness may be required within a product line or across all products

- Packaging hierarchies: Serialization may be required at the unit level (EU), unit and case level (US) or all levels below pallet (China)

- Aggregation: Aggregation may be a legal requirement or a potential trade mandate

- Master data: Company, partner and product data related to serialization requirements varies widely from country to country and across trade partner relationships

So, unless your company will only serve the U.S. market and none of your supply or trade partners does business in other markets, it is critical to understand the diversity of the serialization regulations and how they potentially impact your enterprise IT architecture, your operational processes or the readiness of your supply partners to serve you when you need them.

2. Serialization Forces Supply and Trade Partner Networks to Evolve

You have to understand all potential network connections (internal, supply, trade, governmental) over which serialization information needs to flow, not just internal packaging site or CMO/CPO links, to understand the regulatory and business data flows your infrastructure needs to support. The serialization infrastructure you develop will probably have to support a surprising diversity of data types, connection methods, business preferences and regulatory interpretations across your various network relationships.

For DSCSA, you’ll need to manage serial number requests and responses with the different packaging line systems you and your supply partners work with. Commissioning events must be captured and potential aggregation data exchanges managed as product travels from packaging line to packaging site warehouse, through internal warehouses and into 3PL facilities. Shortages, damaged product and other exceptions need to be dealt with in new ways where serialized product is involved.

Downstream, you may have to send aggregation data to direct trade partners and capture and respond to SNI verification inquiries from any entity that has the product in their possession. Each of these partners may have its own preferences, system capabilities or interpretations which can impact how the serialization system is designed and how the packaging lines are deployed.

3. Serialization Creates Unprecedented Scalability Challenges

The data generated and the transaction events created are orders of magnitude beyond what companies in the pharma supply chain are used to.

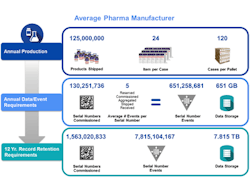

A mid-sized pharmaceutical company that produces 125 million units a year will now, under serialization, be faced with creating more than 130 million serial numbers a year across multiple packaging hierarchies. These serial numbers need to be provided to dozens of internal and external packaging lines and related commissioning, aggregation and other related serialization events from numerous systems and partners across the supply chain need to be captured. Each serialized product unit may spawn a net average of 5 serialization events across packaging, internal movements and supply chain transactions.

Annually, this company will need to capture and manage more than 650 million serial number events. At a typical size of 1 kilobyte per serialization event, this represents more than 650 gigabytes of data per year. Across a 12 year record retention period and at steady state, that exceeds more than a billion serial numbers generated, almost 8 billion serialization events managed and almost 8 terabytes of compliance data to store. Since this data is not just compliance data but also used for daily operational needs, this demands a complete rethink of how information is captured and managed across your business.

4. Serialization Fundamentally Changes How Your Company Conducts Business

Serialization and the management of serialized inventory fundamentally changes how your company conducts business. It’s crucial to reach out across the organization, from quality and artwork, to supply planning, trade relations and commercial operations, to understand how corporate functions are impacted by serialization. Continuous education on serialization regulations and their implementation rules, data standards and industry implementation trends across the organization is important so that you can gain informed feedback on organizational needs, preferences and requirements to inform your serialization planning. For example, good distribution practices in the warehouses may conflict with the needs to maintain aggregation relationships across the organization.

Most companies will undergo a transition from lot-level identified to serialized product over time. So your systems, processes and connections to supply and trade partners will need to be flexible in managing both serialized and lot-level product throughout your organization and network.

5. Serialization Preparation Timelines are Always Longer than They Appear

Serializing packaging lines and serialization enabling a packaging site is long and complicated project which may take from 12-18 months to complete from hardware acquisition to live site validation. But the true serialization readiness timeline must incorporate many other factors.

Depending on product stock levels and velocity through the supply chain, it may take months to bleed out existing lot level product from internal warehouses and external distribution sites. Existing supply plans need to be incorporated to determine how often production runs are executed, how long they take and when existing production lines can be idled for retrofit.

Rarely can all serialization lines be upgraded in parallel due to cost or resource constraints. So, projects must be staged in phases. As each line and site is being serialization-enabled, it must be integrated into the internal serialization architecture linking the enterprise systems, warehouse management systems, edge devices and trading partner systems across which serialization data and serialization events must flow. This places a requirement on the business to understand how this architecture should be developed well in advance of line deployment.

Working back from the deadlines, most companies find that their serialization start date for U.S. DSCSA serialization is several months to more than a year before they expected, not accounting for the lead times required for other serialization regulations.

WHY START NOW?

The approach to serialization must be staged. Or, as we like to say the “big bang” approach just doesn’t work.

Serialization decisions are tightly intertwined with numerous other corporate functions, so starting now helps identify dependencies in supply planning, IT architecture, operational processes and even product commercialization programs.

Starting early also lets you uncover issues and mitigate risks before full-scale serialization and network implementation. For example, does your 2D barcode content match event data? Is serialization data consistently maintained in repository? Do network integrations maintain serialization data?

As you’ve seen, there are many issues to master in preparing for DSCSA serialization deadlines. The requirements far exceed just putting numbers on bottles, as those that have started serialization projects can attest. Start early, understand your true readiness, and build a strategic plan to meet both DSCSA and global regulatory requirements.

ABOUT THE AUTHOR

Brian Daleiden is Vice President of Industry Marketing at TraceLink. In this capacity, Brian leads the company’s thought leadership, global regulatory analysis and market education programs that help industry stakeholders understand and respond to emerging regulatory, business and technical requirements. Brian guides the TraceLink Cloud Community of industry leaders from across the global life sciences supply network. Brian holds an MBA from Vanderbilt University and a BS from the University of Wisconsin.