Biopharma CMO Consolidation: Opportunity or Obstacle?

[pullquote]Outsourcing to contract manufacturers can be a valuable, even critical, option allowing companies to focus their resources and talents on their primary objectives. In some cases, having others do operations that otherwise could not be done efficiently, or at all, in-house is a rational manufacturing strategy. These can include certain R&D or manufacturing tasks where the skills, equipment, or talent are not available in-house. In the biopharmaceutical industry, contract manufacturing organizations provide capacity reservoirs for companies to tap as needed, and the value proposition offered by CMOs can be compelling.

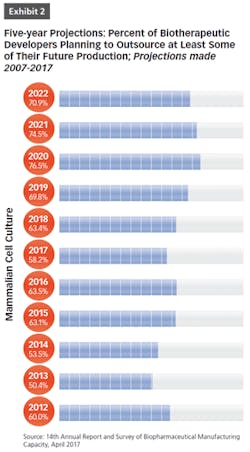

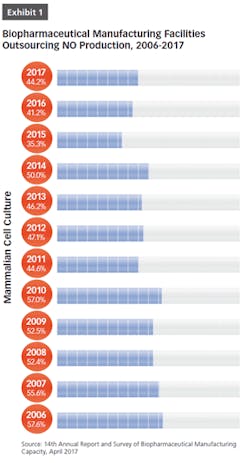

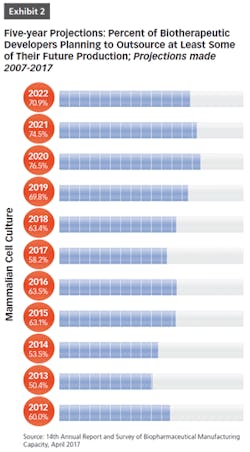

BioPlan Associates’ 14th Annual Report and Survey of Biopharmaceutical Manufacturing includes findings on several key aspects of the contract manufacturing industry’s role in biopharmaceutical R&D and manufacturing. For example, less than half of biomanufacturers surveyed (only 44 percent) now report their facility does all their production in-house (see Figure 1). In other words, 56 percent outsource at least some of their manufacturing; further, 19 percent report outsourcing more than half of their total production operations. These numbers have been steadily increasing over the past decade. But the increasing trend toward CMO consolidation may create problems, as there may be fewer outsource suppliers and less competition, which may decrease options for some companies. This may also lead to constricted capacity, and likely higher prices, as those seeking CMO services tend to bid up the increasingly scarce capacity and project slots.

The biopharmaceutical industry has continued its consolidation among CMOs. And while a certain amount of consolidation — mergers and acquisitions — is normal in most every industry, biopharmaceutical CMOs have recently been particularly active. Both investment firms and existing CMOs are finding the market to include readily sellable commodities/investments, and have been busy merging and acquiring various biopharmaceutical-related CMO assets. This has largely started from the top down, with many of the biggest and most of the mid-tier CMOs having recently been involved in M&A activity.

The CMO industry is highly stratified, with a few major players generating most of the revenue from commercial manufacturing (e.g., billing $100s millions/year); slightly more mid-sized players (e.g., billing up to $100s millions/year); and many smaller clinical-scale CMOs (e.g., billing <$20 million/year). Commercial manufacturing is by far the major revenue source for CMOs, but is restricted to the few mostly largest CMOs, with this involving more resources, larger scales, etc. than pre-commercial projects.

The biopharmaceutical CMO industry has and remains stratified by company size, based on revenue, capacity, projects, clients and, particularly, commercial manufacturing competence. This, in particular, differentiates the largest CMOs from the rest. The biggest international CMOs offer essentially everything conventional product developers would need, from R&D through commercial manufacturing and fill-finish. They necessarily have considerable technological and regulatory expertise, often more than their clients, the Big (Bio)Pharma companies that account for most of their billing. An estimated ≥30 percent of biopharmaceuticals in major markets are commercially manufactured by CMOs, by just a few of the very largest having long been involved in commercial manufacturing. These include Lonza, Boehringer Ingelheim, Sandoz/Novartis and Patheon, each involved in manufacture of marketed biopharmaceuticals, including those with blockbuster status (≥$1 billion/year revenue). Several newer CMOs with super-sized facilities are starting to establish major facilities internationally, including in the U.S. and Europe, while other leading CMOs generally already have facilities in these major markets.

A major factor promoting CMO consolidation, particularly larger CMOs, is that Big (Bio)Pharma clients are making presumptions that larger CMOs are best for their needs. If only due to their size, large CMOs will be expected to have sufficient staff, available capacity, and facilities on multiple continents to address concerns over single-source operations. The largest, affluent biopharmaceutical developers, including the successful innovative product developers, often seek the largest international CMOs. There is good reason for this. The big clients can generally obtain larger discounts and bundle services they may need into large, multi-year contracts. Big clients can reserve large blocks of CMO project time years ahead and not be concerned about having projects to fill these slots. Small biologics developers, on the other hand, lack a critical mass of outsourceable projects and need to do more transactional contract negotiations.

2017 CMO Mergers and Acquisitions

Large CMO consolidation deals in 2017 included:

- Thermo Fisher paying $7.2 billion for Patheon, a top-tier and one of the largest international biopharma industry CMOs

- Catalent, a top-tier CRO with significant biopharma CMO operation, acquired Cook Pharmica, a mid-sized biopharma CMO, for nearly $1 billion, significantly expanding its capacity

- Asahi Glass (Japan) acquired one of the few unacquired mid-sized CMOs — CMC Biologics — for about $500 million

- Lonza acquired Capsugel, a fill-finish company, for $5.5 billion, and other CMOs, e.g., Micro-Macinazion

- Recipharm acquired Kemwell, a major CMO in India

- KBI, a mid-sized CMO which was acquired by JSR, a Japanese chromatography supplier, acquired Opexa Therapeutics to expand its cell/gene therapy services

2017 also brought more large-scale partnering among Big Pharma companies and larger CMOs, and more investments in CMO expansions. For example:

- Sanofi and Lonza are jointly constructing a new monoclonal antibody manufacturing facility in Switzerland

- GE is investing $184 million in a new facility in Ireland to manufacture for several clients

- Lonza is adding 150,000 sq. ft. to its recently-completed 100,000 sq. ft. cell and gene therapies manufacturing facility in Texas

- Vetter is investing $320 million, and Fresenius Kabi is investing $250 million in various new U.S. sterile injectables facilities

Many, if not most, existing CMOs are continuing to report bioprocessing capacity expansions, most involving addition of single-use production bioreactors and process lines. This is besides a growing number of new and established CMOs entering and/or expanding services in new technology areas that are just starting to become more mainstream, notably cell and gene therapies and antibody-drug conjugates (ADCs).

Patheon is perhaps a model of industry consolidation to date and may foreshadow the future. Already one of the largest international biopharmaceutical CMOs, Patheon was acquired in 2017 for over $7 billion by Thermo Fisher, one of the largest sellers of bioprocessing supplies. Recall that originally Gallus, then already a large CMO including commercially manufacturing several biopharmaceuticals, acquired Laureate Pharma, a mid-sized CMO; DPx Holdings, an investment company jointly owned by Ridgemont Equity and DSM, a large chemical company with biopharma CMO capacity, acquired Gallus and merged it into its large, primarily small-molecule oriented Patheon, forming a very large international biopharmaceutical CMO; and Thermo Fisher subsequently acquired Patheon. Owning one of the largest CMOs will obviously provide Thermo Fisher with a wide variety of options for combining and bundling diverse products and services, including using its CMOs as test beds for new products and technologies, and perhaps offering discounts for bundling of both supplies and services. With Patheon, we see not just CMO M&A activity, but acquisition by non-CMO investors — the former Patheon investment/holding company and Thermo Fisher, a diversified high-tech mostly hardware supplier. Presuming the Thermo Fisher integration of Patheon works out, we may well see other pure investment firms and companies not primarily involved in the biopharmaceutical industry acquiring biopharmaceutical CMOs.

Multiple other current leading bioprocessing suppliers also have their own but smaller biopharmaceutical CMO operations, e.g., MerckMillipore/SAFC and GE Healthcare each have multiple facilities worldwide. Several other leading bioprocessing suppliers, notably Pall and Sartorius Stedim, currently do not own any CMOs. Presuming cost-savings from these acquisitions can be realized, clients will likely find such integrated bioprocessing suppliers that also provide full CMO services to be attractive. These cost savings and other benefits could well happen, leading to more mergers. But this is largely dependent on the future prospect of mergers such as Patheon with Thermo Fisher. Further, not every bioprocessing equipment suppliers can also manage services businesses. And some services business have suffered from acquisition by product-oriented companies. Services businesses can require very different operating and marketing philosophies. If not managed well, the unique nature of services businesses can create integration problems, where the client, and ultimately the bottom line can suffer.

Impacts of CMO Consolidation

Whether these super-sized consolidations are good for the biopharmaceutical industry, and for CMO clients is not clear. And whether Big Pharma preference for partnering with fewer, larger suppliers will continue remains to be seen. However, we expect the mergers and acquisitions in recent years will likely also affect remaining independent lower-tier CMOs, as CMO consolidations, largely driven by capturing outsourcing from Big Pharma companies, moves down-scale. Further, it is possible the costs of M&A related financing will put some CMOs in a weaker position, making it more difficult to invest in needed expansions, such as in cell and gene therapy sectors.

The largest CMOs, each with multiple world class-size facilities, are particularly attractive to large clients because larger CMOs can offer broader, large-scale manufacturing infrastructure, and more specialized bioprocessing and regulatory expertise. These clients are increasingly looking to outsource much of their less innovative R&D and products, such as conventional antibodies and proteins, biosimilars, etc. to large, commercial scale CMOs. In many respects, the largest CMO facilities and expertise often surpass that of their Big (Bio)Pharma clients. These CMOs generally handle all, from cell line through fill-finish and packaging, and can do this at geographically-distributed facilities, often offering better access to local/regional markets and providing 2nd-source backup commercial manufacturing at geographically-distributed facilities.

However, a common complaint among smaller and mid-size clients is that they are ignored by large CMOs. Their smaller single projects often do not fit well within the largest CMOs. Smaller clients and projects often get delayed, besides services costing more than at smaller but less capable CMOs. Mergers create larger CMOs that often are not perceived as suitable partners for smaller clients.

The largest CMOs generally have well-developed proprietary in-house manufacturing platforms, including those used at commercial scales, often for multiple products. These platforms can provide benefits, as CMOs plug clients’ products into their established platforms and practices, saving time and potentially costs. Leading CMOs are also likely to have already licensed any needed third-party technologies. This works well for product developers with conventional bioprocessing, such as mainstream recombinant monoclonal antibodies and proteins with conventional structures. However, established CMO technology platforms often do nothing for clients with more innovative or newer classes of products, such as novel antibody structures, cell and gene therapies, antibody-drug conjugates, live microorganisms as therapeutics, etc. Many of these prospective clients complain that the largest CMOs primarily want to do production their way using established platforms. This particularly affects smaller developer companies, which are often forced to go to smaller and less experienced CMOs more willing to adapt and accommodate unique technology needs.

Large CMOs’ size and established platforms allow increased efficiency and economies-of-scale, compared with smaller CMOs, with their commercial manufacturing providing higher billing and margins (vs. R&D support) over long periods. Large CMOs often charge higher prices due to their capabilities, and established track records. However, many smaller companies, which tend to have more innovative products, must often adopt development strategies involving different, smaller CMOs for R&D and clinical needs, and then consider hiring yet another CMO to handle commercial manufacturing.

Smaller CMOs, of which there are many, and mid-sized CMOs, of which there remain relatively few not merged/acquired, are needed by the biopharmaceutical industry to fill niche segments. In our prior studies, we have found that smaller CMOs can often be better partners. Smaller CMOs can provide preclinical and early clinical phase support comparable in quality, time, etc. to that of the largest CMOs, while generally lacking in facilities and experience for commercial manufacturing. For many smaller biologics developers, smaller CMOs can do what is needed pre-commercially in comparable timeframes. However, for some clients and projects, smaller CMOs may come up short in terms of manufacturing, regulatory and other expertise.

Future of Biopharmaceutical CMO sector

Pressures and good rationale for outsourcing to CMOs persist, and CMOs of all sizes will continue to grow, as this sector is tracking with the ~10 percent annual growth in biopharmaceutical products revenue. But much of the future of the biopharmaceutical CMO sector and broader industry will be dependent on near-term responses to consolidations so far, including perceived needs for consolidation among CMOs and their owners.