Strong Growth Ahead for Contract Manufacturing

Contract manufacturing organizations (CMOs) of small- and large-molecule drug substances and formulated drug products have had profitable businesses in recent years, including 2015. Growth rates for contract manufacturing have been much higher than that of the market for the pharmaceutical/biopharmaceutical industry due to several factors:

• Increasing consumption of medicines around the world, both in emerging markets as incomes rise and mature markets due to aging of the population;

• A more robust pipeline of drug candidates and an increasing rate of FDA NDA/BLA approvals;

• The growing number of biologic drugs in development, many by traditional pharma companies that lack biotech expertise;

• The entrance of numerous small, virtual startups into the market that have no manufacturing capacity;

• The rise in patent expiries and increasing generics competition, which is driving a greater need for cost efficiencies and access to novel, proprietary technologies for achieving product differentiation;

• And the increasing complexity of both small- and large-molecule drugs, such as antibody-drug conjugates (ADCs) and highly potent compounds that require specialized skills and capabilities.

There are questions, however, as to how long such strong growth can continue. Merger and acquisition activity has been rampant among both sponsor companies and contract service providers, leading to real consolidation within both sectors. Several pharma firms have also acquired contract service providers to achieve vertical integration. Others have elected to invest in their own in-house capabilities — often smaller, flexible, multiproduct facilities designed to meet the dynamic needs of today’s marketplace.

Both strategies are designed to limit the need for outsourcing. As a result, contract service providers that wish to attain a similar level of growth going forward will need to find a way to provide measurable added value that sponsor organizations cannot realize on their own. Emerging markets, value-added generics (so-called supergenerics), and biosimilars provide other potential opportunities for growth if contract manufacturers have the global reach and technical capabilities necessary to capitalize on them.

STRONG MARKET GROWTH EXPECTED FOR YEARS

The global contract (bio) pharmaceutical manufacturing market is predicted by Visiongain (February 2015) to reach $79.24 billion in 2019, increasing at an average annual rate of 7.5% from $54.54 billion in 2013 (1). The market research firm also expects strong revenue expansion to continue through 2025. Key drivers identified by Visiongain include growth of biologic drugs and biosimilars, including the growing demand for novel therapies such as antibody-drug conjugates, treatments based on highly potent active pharmaceutical ingredients (HPAPIs) and regenerative medicines.

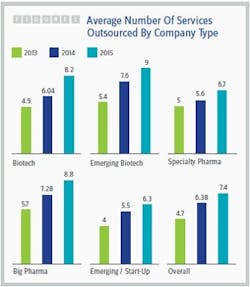

The healthy growth of the contract services market isn’t surprising in light of the trends identified by Nice Insight’s annual Pharmaceutical and Biotechnology Outsourcing survey of more than 2,300 outsourcing-facing pharmaceutical and biotechnology executives (2). While the percentage of survey participants whose companies spend more than $50 million on outsourcing has remained fairly stable over the last three years (23 to 24 percent), the percentage of respondents whose companies spend $10 million to $50 million on outsourcing has increased dramatically from 38 percent to 62 percent, while the percentage of participants whose companies spend less than $10 million has decreased by slightly more than half (43 to 16 percent). In addition, the average number of services outsourced by survey participant companies increased from 2014 to 2015, regardless of the buyer group or budget size. See Figure 1.

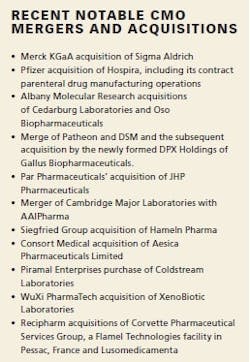

HEIGHTENED M&A ACTIVITY TO CONTINUE

A continued high level of M&A activity is expected by Visiongain over the next five years, leading to further consolidation of the contract services market (1). The key driver: the desire of contract manufacturers to provide integrated service offerings across the entire pharmaceutical development cycle from discovery to commercialization (APIs and formulated drug products) and lifecycle management. The number of contract manufacturing organizations (CMOs) transforming themselves into contract development and manufacturing organizations (CDMOs) reflects this trend, as does the rise in the number of primary contract manufacturers that have expanded into secondary (finished dose) manufacturing (and vice versa) through mergers or acquisitions.

In fact, according to PharmaSource, just 30 CMOs account for more than half of the industry’s revenues (3), and more than 18 acquisitions in the CMO space (including only CMO-CMO deals) have taken place in the last three years alone (3). Acquisitions of facilities from sponsor pharmaceutical and biopharmaceutical companies also continues, but at a slower pace than in the past (4).

There are several reasons CMOs are acquiring one another: to gain a more global footprint to meet client needs for global partners and large-scale capabilities for greater cost efficiencies; to expand into service areas (development, final formulation); and to gain access to advanced technologies. Overall, CMOs are looking to become CDMOs in order to develop extensive networks of capabilities similar to what sponsor companies have access to in-house, but with cost, productivity and technological advantages.

The internal investments being made by CMOs and CDMOs add up to quite significant sums and are too numerous to mention. Leading the pack is Catalent, which also recently acquired several companies (Pharmapak Technologies, Redwood Bioscience and Micron Technologies). Both Catalent and Patheon announced initial public offerings to raise capital for further expansions.

THE VALUE OF INTEGRATED SERVICES

These activities seem to indicate that the CDMO concept has been well established. They also underscore the recent trend toward the formation of strategic partnerships with a few preferred suppliers that have the expertise to support fully integrated capabilities and culture, systems and processes necessary for the development of collaborative relationships.

This approach allows drug manufacturers to meet aggressive development times while realizing greater efficiencies in their own supply chains. According to the Nice Insight survey results, sponsor companies look for strategic partners that have the capability and willingness to collaboratively develop operating procedures, use dedicated project managers, demonstrate a clear willingness to make long-term commitments, and the ability to customize protocols for different projects (2).

It remains to be seen, however, whether the newly formed CDMOs resulting from the frenetic M&A activity can actually provide fully integrated services that meet the expectations of pharmaceutical and biopharmaceutical sponsor firms.

COST NO LONGER THE MAIN SELECTION CRITERIA

The focus on cost reduction initially associated with the growth of outsourcing no longer seems to exist today. Quality has supplanted cost savings as the key criterion when sponsor companies are seeking contract service partners. For three years in a row, respondents to Nice Insight’s survey have indicated that quality and reliability are the top two priorities, while affordability has dropped in priority as one of the drivers for selecting an outsourcing partner (2). See Figure 2. Poor quality also remains the top source of dissatisfaction for survey respondents, followed by a lack of timeliness in resolving problems and unexpected charges.

It’s also worth noting that FDA in 2015 opened its Office of Pharmaceutical Quality, which is anticipated to aid the agency in more effectively addressing quality management issues in the pharmaceutical industry.

Respondents of the Nice Insight survey that work for sponsor companies are also keenly interested in contract service providers that have track records of success, financial stability and an industry reputation for doing quality work (2). Partners with operational, methodological, and therapeutic experience to meet a wide range of project needs and the ability to be adaptable and flexible are also preferred. Clearly demonstrated communication skills, a willingness to be transparent and a deep understanding of customer needs are also important to survey respondents, as are a reputation for being responsive, willingness to go the extra mile to ensure success and implement sponsor methodologies, and an eagerness to foster good rapport among project team members.

GREATER ROLE FOR ADVANCED TECHNOLOGIES

Candidate drugs today are more complex and challenging to formulate, often requiring unique solutions to ensure high bioavailability, efficacy and safety. Many of these complex drugs are also granted orphan drugs, breakthrough therapy, and/or fast track designations from the FDA and must be commercialized in half the normal time. At the same time, payers, governments, physicians and patients are requiring demonstration of value, and the shift to evidence-based medicine is placing additional cost and performance pressures on drug manufacturers. Generic competition is fierce, and the need to gain additional profits through the extension of product lifetimes is becoming an additional necessity.

In many cases, sponsor companies do not have access to all of the state-of-the-art technologies that are necessary to develop and commercialize the complex APIs and formulated drug products in their pipelines. Outsourcing is an efficient and cost-effective way to gain access to the most advanced technical solutions. As a result, CMOs and CDMOs that can offer the most advances in technical capabilities, and more importantly novel, proprietary technologies, have the greatest chance of attracting the attention of sponsor firms. As sponsor firms continue to pare down their vendor numbers and establish strategic partnerships with fewer, integrated suppliers, technological capabilities will only become greater differentiators.

According to the results of the Nice Insight survey, the introduction of innovative, new technologies to the lab, manufacturing plant and supply chain is helping service providers attract projects from sponsors looking to be first to market with differentiated products. A high percentage of respondents (96 percent) also indicated that they have at least some interest in forming outsourcing partnerships with service providers that adopt state-of-the-art technologies to increase efficiency, safety, quality and traceability. In addition, the level of technological innovation at a potential outsourcing partner influences the selection process for survey respondents. The use of advanced technologies to enhance safety is most important, followed by improving efficiency, security, regulatory compliance, patient compliance, speed, loyalty and traceability. See Figure 3.

SPONSOR COMPANIES MAKING THEIR OWN INVESTMENTS

Currently, CMOs account for approximately 33 percent of the pharmaceutical industry’s cost of goods (COGs) for drug product manufacturing (4). That number isn’t likely to change, particularly given that sponsor companies, in response to their more robust pipelines and strong cash positions, have begun to invest in additional internal manufacturing capabilities.

According to PharmaSource, spending on plant and equipment by the 25 largest bio/pharma companies grew 13 percent in 2013, and 11 percent more in 2014 to $19 billion. Some drug companies are also acquiring CMOs (e.g., Pfizer’s acquisition of Hospira). In addition, as mentioned above, many sponsor firms are looking to simplify their CMO networks by working with fewer CDMOs that can support their projects from the development phase through clinical trials and on to commercial API production and drug product formulation.

SLOWING AHEAD? IT DEPENDS

While increasing investments in production capabilities by drug manufacturers may limit the potential growth of contract manufacturing services to these traditional customers going forward, there still remain opportunities for CMOs and CDMOs to expand their businesses.

For those companies with truly integrated offerings and unique technical capabilities, there are opportunities for collaborative capacity management and long-term, multi-project relationships. The expanding biosimilars and biobetters markets will create additional demand for contract development and manufacturing support, particularly from service providers that can offer both quality and cost advantages. Similarly, there is a real need for lifecycle management support of off-patent, small-molecule drugs through the development of modified generics with uniquely enhanced properties from technically advanced contract service providers.

Finally, CMOs/CDMOs with the ability to establish manufacturing facilities in emerging market countries can position themselves for strong growth, given that demand is expected to expand rapidly in the coming years and the contract service market is in its infancy in these regions. It is also worth noting that increased competitiveness in the contract service market will ultimately benefit the survivors, who will see improved pricing and increased margins.

REFERENCES

(1) Visiongain, “Pharmaceutical Contract Manufacturing World Market To Reach $79.24bn in 2019”, Press Release, February 10, 2015.

(2) Nice Insight, 2015 Pharmaceutical and Biotechnology Outsourcing Survey, January 2015.

(3) PharmSource, Contract Dose Manufacturing Industry by the Numbers, 2015 Edition, July 2015.

(4) J. Miller, Pharm. Tech. 39 (17), 26-211 (2015). By Nice Insight