What’s the future of Bio Pharma? While no one’s crystal ball is clear enough to exactly predict where the industry is headed, it remains perfectly clear Bio Pharma is soaring, climbing to a new cruising altitude, flying higher than ever as it becomes the carrier of choice for the future of the pharmaceutical industry.

John J. Castellani, president and CEO of Pharmaceutical Research and Manufacturers of America (PhRMA) offered this in his letter introducing the association’s “2015 Biopharmaceutical Research Industry Profile:” Massive change continues across the United States and global health care systems driven by new health care policies, demographic shifts, changes in lifestyle, but — most of all — evolving, accelerating science.” His final remark, “evolving, accelerating science” succinctly describes the force from which Bio Pharma has and will continue to derive its lift. Research and development spending by its members, according to PhRMA, grew from $2 billion in 1980 to an estimated $51.6 billion in 2013. The percentage of sales that went to R&D in 2013 reached 23.4 percent of domestic sales.

Apparently a lot of that R&D money was spent by the Bio Pharma sector. The U.S. biopharmaceutical industry is one of the most research-intensive industries in the country, says PhRMA’s report, investing more than 13 times the amount of R&D per employee than manufacturing industries overall. According to the National Science Foundation, the U.S. biopharmaceutical sector accounts for the single largest share of all U.S. business R&D, representing about 1 in every 5 dollars spent on domestic R&D by U.S. businesses.

Of the billions of dollars spent on R&D each year by the biopharmaceutical industry, the vast majority is spent on clinical research, says PhRMA’s report, accounting for roughly 90 percent of all spending on clinical trials of medicines and devices in the United States. In 2013, PhRMA says the biopharmaceutical industry sponsored an impressive 6,199 clinical trials.

Everyone knows developing biopharmaceutical drugs is expensive. Average time to develop a new drug is more than 10 years, and the percentage of drugs entering clinical trials resulting in an approved medicine equal less than 12 percent. Current estimates peg the cost to successfully develop and bring to market a new drug at more than $2.6 billion. PhRMA notes rapid changes in molecular science have ushered in a new era of innovative biopharmaceuticals and their rise has been spectacular, especially over the last 10 years. From the first angiogenic medicine for Cancer in 2004 to oral treatments for Hepatitis, 17 new drugs for rare diseases and 7,000 medicines in development in 2014, Bio Pharma has truly ascended to a new level.

MONEY WELL SPENT

Forbes Magazine contributor Bernard Munos notes in a recent article that 2014 was a great year for pharmaceutical innovation for both New Chemical Entities (NCEs) and New Biological Entities (NBEs): “The best, in fact, since the industry’s all-time record of 1996.” Munos says in 2014 the FDA approved a total of 44 drugs, 39 by CDER, and 5 by CBER. Explaining that the total excludes imaging agents and includes only the biologicals drugs that are of rDNA origin, Munos reported that biologicals captured “a total of 16 approvals (35 percent) — a big hike from 2013 when they garnered 22 percent. Seventeen of these drugs (39 percent) featured novel modes of action, as in 2013 (37 percent).”

Munos says that compared to innovation during the pre-2010 decade that was dominated by mediocre, overpriced drugs, “we are now seeing cure rates (hepatitis) or remission rates (cancer) that are nothing short of stunning.” Regarding biopharmaceutical innovation, Munos says the industry is “witnessing rapid progress with a range of new technologies such as CAR T-cell, gene editing, synthetic biology, biochips, bioprinting, and tissue engineering that promise to transform treatments for entire therapeutic areas — such as rare diseases — as well as produce tools that will speed drug R&D and lower its costs.”

TO COME: HYPER INNOVATION

Munos notes that far from running out of innovation, “we are actually on the cusp of a hyper-innovation age that will see treatment options expand from small molecules, monoclonals and peptides to a whole range of new and more effective therapies.” But this innovation won’t be free from challenges or a fair measure of risk, and companies that will emerge as leaders will need to be more aggressive, less conservative and push past their comfort zones to succeed. “These innovation champions,” says Munos, “include Novartis, J&J, GlaxoSmithKline, as well as recent converts such as AstraZeneca that are working hard at restoring a vibrant culture of innovation to their R&D operations.”

In its report “Advanced Biopharmaceutical Manufacturing: An Evolution, Underway,” Deloitte’s analysts find the past 10 years have seen a significant shift in the nature of the products being manufactured and sold by the Bio Pharma industry. “The global biopharmaceutical portfolio of today reflects increased therapeutic competition, a greater prevalence of large molecule drugs, expansion in the number of personalized or targeted products, and a rise of treatments for many orphan diseases.” These trends, says the report, have driven a rise in biopharmaceuticals with “extremely limited production runs, highly specific manufacturing requirements, and genotype-specific products.” This fundamental shift in the overall product mix, says Deloitte, and a focus on improving the efficiency and “effectiveness of production is spurring an evolution in the technologies and processes needed to support advanced biopharmaceutical manufacturing.”

According to Deloitte, innovation in manufacturing technology will drive better economics, flexibility and quality while benefiting patients both directly and indirectly.

Where will Bio Pharma’s players be investing their capital dollar? Deloitte identifies the following as targets for improving the operational excellence of biopharmaceutical manufacturing assets:

• Continuous manufacturing to improve scalability and facilitate time to market, while lowering capital and operating costs and enhancing quality.

• New process analytical tools to improve process robustness, accelerate scale-up to commercial production and drive more efficient use of resources.

• Single-use systems to increase flexibility and reduce production lead times, while lowering capital investment and energy requirements.

• Alternative downstream processing techniques to improve yields while lowering costs, green chemistry to reduce waste, and new vaccine and therapy production methods to increase capacity, scalability and flexibility.

AMGEN'S TAKE

Amgen’s vice president for Process & Product Development Jim Thomas, offered Amgen’s take on how to achieve operational excellence in the presentation “Biopharmaceutical Manufacturing Technology: Vision for the Future.” Thomas explains that only the highest quality manufacturing environments will answer the demands of a rapidly changing industry earmarked by “a more competitive business environment, a more challenging reimbursement environment, and a more conservative regulatory environment.”

Thomas and his team at Amgen describe their strategy in a holistic way using the mantra “Design the molecule. Design the process. Design the Plant,” and that molecule heterogeneity can be influenced by the manufacturing process. Compared to current methodologies, there are both upstream and downstream opportunities to reduce variation and improve yields.

Figure 1

Trends in analytical tools, notes Thomas, will support operational excellence and quality goals in biopharmaceutical process by measuring host cell proteins, measuring molecule fragmentation, and measuring protein microheterogeneity. Thomas and Amgen point out that the tools for analysis (a key element to their corporate manufacturing strategy) have come a long way since the ’90s and that by 2020 mass spectroscopy-based analysis will provide host protein fingertips, top-down analysis and routine analysis of CQAs to support biopharmaceutical development and manufacturing.

How will biotherapeutics be manufactured in the future, Amgen wonders? To Thomas and his colleagues the most likely scenario won’t involve transgenic animals, transgenic plants or cell-free systems, but center on cell-based systems. That makes correctly mapping the design space of critical unit operations all the more a priority and will be important for building quality into the manufacturing process. What is called for, says Thomas, is two-fold: High throughput processes and high throughput purification.

HOLISTIC APPROACH TO OPTIMIZATION

To achieve higher yielding processes, greater plant flexibility, and better utilization of capital, as well as a significant reduction in operating costs, Thomas and Amgen are pursuing a holistic approach to optimization that encompasses process design, plant design and process control.

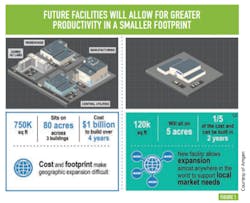

In keeping with its history of manufacturing innovation and excellence, Amgen launched its “Transforming Biotechnology Manufacturing” initiative, which the company touts as “leading the way in the development and use of manufacturing technologies that will set the standard for the future.” Amgen says future facilities will allow for greater productivity within a smaller footprint. According to Amgen’s infographic, cost and footprint make geographic expansion difficult and that its new facility concept allows for expansion “almost anywhere in the world to support local market needs.” Indeed, especially when Amgen is projecting 60-70 percent square foot reductions at 1/5 the cost of existing plant designs, which Amgen puts at more than $1 billion. (See Figure 1: Future Facilities Will Allow for Greater Productivity in a Smaller Footprint.)

Flexibility within this advanced biomanufacturing environment is another goal; Amgen says this will come from streamlining processes — moving from complex, varied processes at different stages of drug development to standardized processes across all stages of development —something many will recognize as a direct path to operational excellence and cost efficiency. (See Figure 2 )PAT AND CONTROL

Deloitte’s analysts agree with Amgen explaining that new process analytical tools can help improve process robustness, accelerate scale-up to commercial production and drive more efficient use of resources. The FDA defines process analytical technology (PAT) as “a system for designing, analyzing and controlling manufacturing through timely measurements (i.e., during processing) of critical quality and performance attributes of raw and in-process materials and processes.”

Deloitte’s analysts explain that when it comes to biopharmaceutical process monitoring, PAT equipment is helpful in understanding biological, chemical and physical attributes, as well as univariate factors. “In manufacturing with PAT,” says Deloitte, “continuous monitoring determines if the process is operating as expected and allows correction of errors at the time of their occurrence.”

This is fortunate, because most understand the overarching goal of PAT is to ensure final product quality. Process analytical technology, say Deloitte analysts, is based on the FDA’s perspective that “quality cannot be tested into products; it should be built-in or should be by design.”

Similarly, PAT is well aligned with the R&D process, says Deloitte, “as companies can begin using it in clinical manufacturing and then continue to use it during scale-up in an effort to ensure consistent quality and reduce time to market.” Deloitte’s report affirmed PAT’s role in operational efficiency and excellence in that it enables both real-time release testing and parametric batch release to further quality assurance goals.

From a cost-control perspective, Deloitte finds PAT can promote fewer recalls and less scrap inventory, more efficient equipment deployment and capacity utilization, as well as an organization’s ability to manage raw material variability, for instance, all of which can potentially reduce the overall price tag associated with manufacturing biologics of all types. “Finally,” notes Deloitte, “the advancement of continuous manufacturing is largely connected to PAT, as continuous processes by definition do not have stoppages or support traditional product quality testing, PAT addresses the need to monitor product continuously, raise any specification exceptions immediately, or adjust the process through advanced process controls based on predictive manufacturing process models.”

A CONTINUOUS FUTURE?

Some companies have developed continuous technology for certain parts of their manufacturing process, say Deloitte’s analysts, “but few, if any, have announced the use of a fully continuous bioprocessing system in commercial production.” Bayer and Genzyme, cites Deloitte, have been using continuous perfusion technology for large molecules in the initial phase of upstream processing for the past two decades and have manufactured at least 12 products via these methods.

The industry is well aware of continuous processing’s potential for the manufacture of small molecule drugs, but for large molecule drugs not so much. According to Deloitte “it can improve quality by constantly maintaining media nutrients and avoiding lags that reduce cell viability.”

The FDA, says Deloitte’s study, views continuous manufacturing as consistent with the FDA’s quality by design efforts, as it has resulted in a more modern manufacturing approach, enables quality to be directly built into process design, and has the potential to improve assurance of quality and consistency of drugs. Regardless, continuous manufacturing has its challenges and biopharmaceutical manufacturers aren’t likely to adopt the operational doctrine wholesale anytime soon. Amgen, as outlined, is committed to optimizing batch operations for its processing future and this kind of long-term investment, notes Deloitte, is just one headwind continuous process faces within the Bio Pharma segment.

Deloitte points out that for the purposes of biopharmaceutical process quality control, manufacturers are challenged, among other things, on how to define a batch in cases of product recall, for example. “As a result, continuous manufacturing requires new methods of measuring quality and gathering metrics.” Continuous manufacturing is not necessarily the most economical method for low-volume, high-value products and would not offer any production gains as opposed to the efficient, well-planned and engineered facilities Amgen and other Bio Pharma innovators are instituting to attain their own vision of biopharmaceutical manufacturing’s future.